汇总好了!CFA二级财务报表重难点!财务报表分析是CFA一级考试的考试重点,内容涉及三大会计报表、现金流量测控、养老会计、管理会计等会计术语,考试难度不是很大但财报分析考试题量多,对于没有会计知识的考生来说难免感到头大,并且现在的考核方式更加灵活,大家还是要提起重视!

正保会计网校的老师给大家总结了CFA二级财报分析里面的重点难点,帮助大家更快的了解和掌握知识点,备考CFA二级考试的同学快来学习吧!内容比较多,大家也可以留存下文章链接呦!

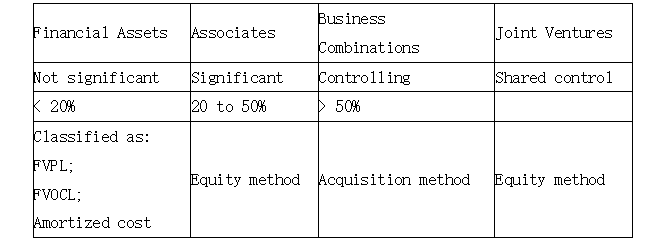

1. 公司间投资

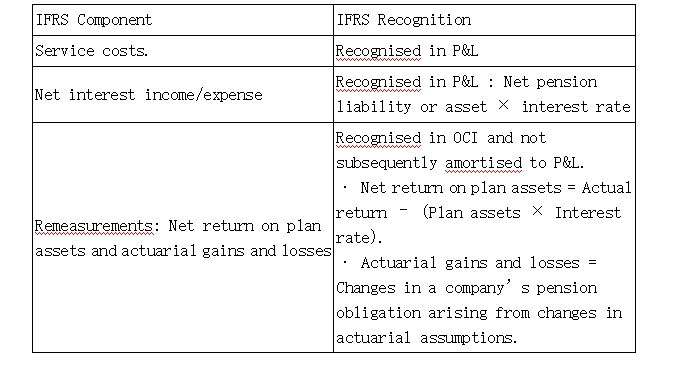

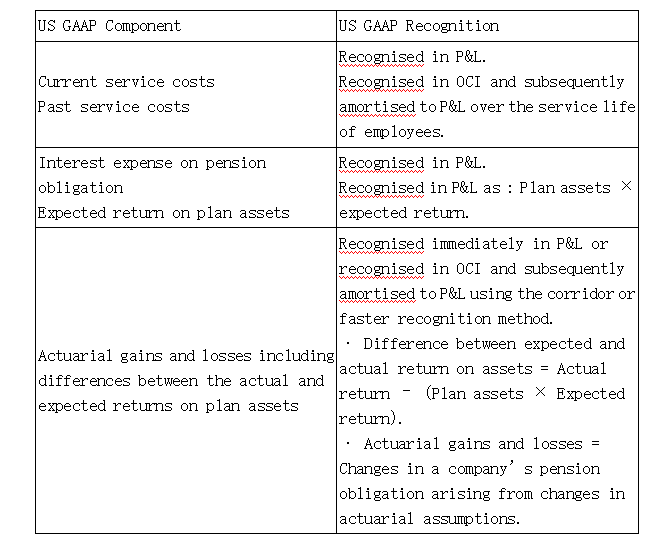

2.养老金计划的会计计量

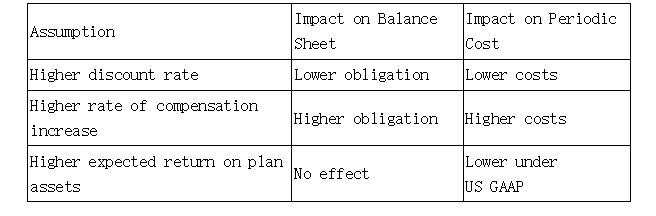

3.DB Plan假设的变化对报表的影响

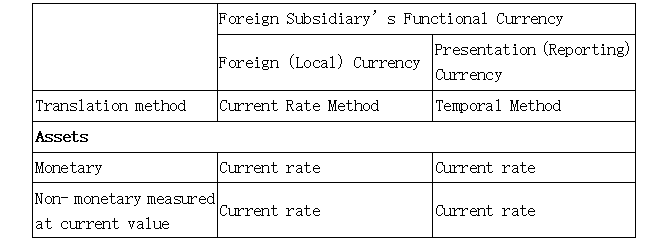

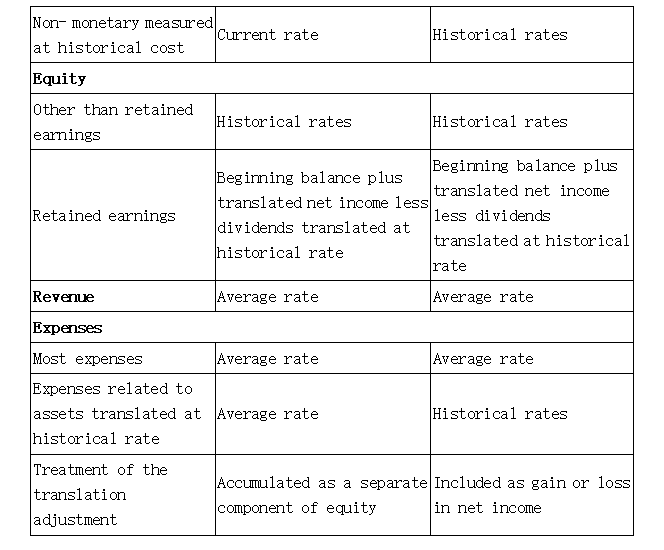

4.外币折算

5.巴塞尔协议

1) 资本充足率及要求

①Capital adequacy = bank’s capital / bank’s assets

②Minimum capital requirements:

• Common Equity Tier 1 Capital / Risk-weighted Assets ≥ 4.5%

• Total Tier 1 Capital / Risk-weighted Assets ≥ 6.0%

• Total Capital (Tier 1 Capital plus Tier 2 Capital) / Risk-weighted Assets ≥ 8.0%

2) 最低流动性标准

①Liquidity Coverage Ratio (LCR)= highly liquid assets / expected cash outflows target minimum of 100%.

②Net Stable Funding Ratio (NSFR)= available stable funding / required stable funding target minimum of 100%.

6.保险公司利润指标

1) Property and Casualty Insurance Companies财产及意外伤害保险公司

①loss and loss adjustment expense ratio = (Loss expense + Loss adjustment expense) / Net premiums earned

②Underwriting expense ratio = Underwriting expense / Net premiums written

③Combined ratio = Loss and loss adjustment expense ratio + Underwriting expense ratio

④Dividends to policyholders ratio = Dividends to policyholders / Net premiums earned

⑤Combined ratio after dividends = Combined ratio + Dividends to policyholders (shareholders) ratio

2) Life and Health Insurance Companies人寿和健康险保险公司

①total benefits paid / net premiums written and deposits

②commissions and expenses incurred / net premiums written and deposits

以上就是CFA二级财务报表重难点的相关内容,后期会为大家持续更新备考干货,可关注【 备考经验 】栏目查看哦!

说明:因考试政策、内容不断变化与调整,正保会计网校提供的以上考试信息仅供参考,如有异议,请考生以官方部门公布的内容为准!

相关推荐>>

了解详情大学生专享