Understanding business partnerships is an important element of CAT Scheme Papers 3 and 6, Professional Scheme Paper 1.1, and new ACCA Qualification Paper F3. This article looks at the ways in which partnerships are formed, structured, and accounted for.

DEFINITIONS

Partnership

A partnership is a business formed by a minimum of two people who pool their resources together towards a common goal. Partnerships are generally formed through verbal arrangements or by deed – a legally binding document, drawn up by the partners, which safeguards their interests in the case of a dispute or misunderstanding. In lieu of a deed, the partnership is governed by local law (for example, the Partnership Act 1890 in the UK). The law does not offer solutions that would be contrary to the wishes of partners. Instead, it provides a set of standard procedures which can be followed by any partnership, and are therefore not tailored to any individual partnership.

Partnership agreement

This is the agreement made among the partners – the policies, formulated by the partners, under which the partnership business will be governed. Some of the principles that might be covered under such an agreement include:

· share of profit and loss

· rate of interest on partners’ capital, and on any loans or advances

· salary to be paid to partners

· interest on drawings

· working schedule and specialisation.

In the absence of a partnership agreement, local law would come into effect. As an example, in the UK, the Partnership Act of 1890 sets out the following principles:

· profit or loss should be shared equally between partners

· no salary should be paid to partners

· no interest on drawings should be charged to partners

· no interest should be credited to partners for their capital

· invested

· any loans and advances, apart from the capital invested by the partners, are entitled to 5% interest per annum.

·

ADVANTAGES AND DISADVANTAGES OF OPERATING AS A PARTNERSHIP AS OPPOSED TO A SOLE TRADER

The advantages of a partnership are as follows:

· more capital can be raised because of the number of partners

· specialised management – each partner can work in the area in which they are qualified or have expertise

· continuation of the business if one partner dies or retires

· partners can better afford to take a long break or holiday.

The disadvantages of a partnership are:

· the decision-making process can be slower due to consultation among partners

· many partnerships end in disagreement

· the profit has to be shared among partners

· there is unlimited liability if the business has to wind up. (Unless a limited liability partnership (LLP) is formed. LLPs are outside the scope of this article.)

ACCOUNTING FOR A PARTNERSHIP

Just as for a sole trader, a partnership also prepares an income statement/profit and loss account and balance sheet. The income statement/profit and loss account for a sole trader is the same as that of a partnership, as is the net assets part of the balance sheet. However, the capital part of the balance sheet is different from that of a sole trader. In order to prepare the capital part of the balance sheet for a partnership, there are three workings that must be completed:

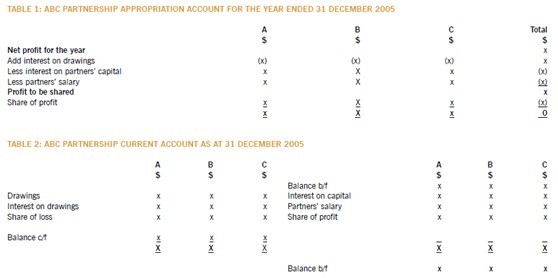

Partners’ appropriation account – this working is used to share out the profit or loss of the business between the partners.

Partners’ current account – this working is done to show how much money is owed to the partners by the partnership business, or how much money is owed to the partnership business by the partners.

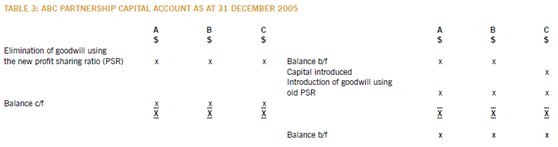

Partners’ capital account – this working is drawn up to check how much money is invested in the business by the partners.

Page: 1 2 See the original article>>

精品好课免费试听