The growth and popularity of the use of Islamic finance has been exceptional

since the Central Bank of Bahrain issued the first sovereign sukuk bonds in

2001. It is estimated that by the end of 2012 Islamic financial assets will have

exceeded $1,600bn, which is around 1–2% of global financial assets

worldwide.

ACCA recognised the importance of Islamic finance and introduced it in the

Paper F9 syllabus two years ago. The ACCA syllabus states students should be able to: ‘Identify and briefly discuss a range of short- and long-term Islamic

financial instruments available to businesses.’

From this year, Islamic finance becomes part of the Paper P4 syllabus, but at a

different level to that which is tested at Paper F9. A successful Paper P4

student must: ‘Demonstrate an understanding of the role of, and developments

in, Islamic financing as a growing source of finance for organisations;

explaining the rationale for its use, and identifying its benefits and

deficiencies.’

This article is focused on Islamic finance as a growing and important source of

finance. In particular, it looks at the success and failure of the use of sukuk

bonds to finance the purchase of assets. However, for the purpose of reference,the attached appendix explains the basic principles of Islamic finance.

Sukuk finance

What is sukuk finance? The official definition provided by the Accounting and

Auditing Organization for Islamic Financial Institutions (AAOIFI), the Bahrainbased Islamic financial standard setter, is ‘certificates of equal value

representing undivided shares in the ownership of tangible assets, usufructs

and services or (in the ownership of) the assets of particular projects or special

investment activity.’

Sukuk is about the finance provider having ownership of real assets and

earning a return sourced from those assets. This contrasts with conventional

bonds where the investor has a debt instrument earning the return

predominately via the payment of interest (riba). Riba or excess is not allowed

under Sharia law.

There has been considerable debate as to whether sukuk instruments are akin

to conventional debt or equity finance. This is because there are two types of

sukuk:

l Asset based – raising finance where the principal is covered by the

capital value of the asset but the returns and repayments to sukuk

holders are not directly financed by these assets.

l Asset backed – raising finance where the principal is covered by the

capital value of the asset but the returns and repayments to sukuk

holders are directly financed by these assets.

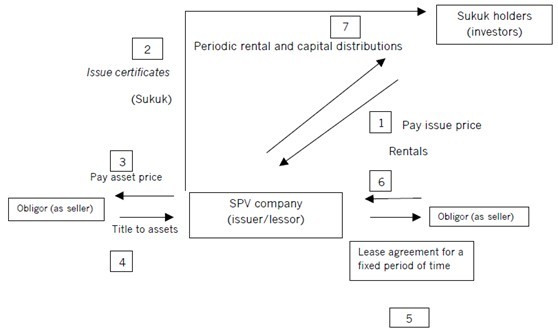

There are fundamental differences between these. The diagrams set out below explain the mechanics of how each sukuk operates.

Asset-based sukuk

Sukuk Al-ijarah: financing acquisition of asserts or raising capital through sale

and lease back.

1. Sukuk holders subscribe by paying an issue price to a special purpose

vehicle (SPV) company.

2. In return, the SPV issues certificates indicating the percentage they own

in the SPV.

3. The SPV uses the funds raised and purchases the asset from the obligor

(seller).

4. In return, legal ownership is passed to the SPV.

5. The SPV then, acting as a lessor, leases the asset back to the obligor

under an Ijarah agreement.

6. The obligor or lessee pays rentals to the SPV, as the SPV is the owner

and lessor of the asset.

7. The SPV then make periodic distributions (rental and capital) to the

sukuk holders.

Asset-backed sukuk

Sukuk: Securitisation of Leasing Portfolio

1. Sukuk holders subscribe by paying an issue price to a SPV company.

2. In return, the SPV issues certificates indicating the percentage they own

in the SPV.

3. The SPV will then purchase a portfolio of assets, which are already

generating an income stream.

4. In return, the SPV obtains the title deeds to the leasing portfolio.

5. The leased assets will be earning positive returns, which are now paid to

the SPV company.

6. The SPV then makes periodic distributions (rental and capital) to the

sukuk holders.

7. With an asset-based sukuk, ownership of the asset lies with the sukuk

holders via the SPV. Hence, they would have to maintain and insure the

asset. The payment of rentals provides the return and the final

redemption of the sukuk is at a pre-agreed value. As the obligor is the

lessee, the sukuk holders have recourse to him if default occurs. This

makes this type of sukuk more akin to debt or bonds.

Asset-backed sukuk certainly have the attributes of equity finance – the asset is owned by the SPV. All of the risks and rewards of ownership passes to the SPV. Hence, should the returns fail to arise the sukuk holders suffer the losses. In addition, redemption for the sukuk holders is at open market value, which

could be nil.

精品好课免费试听