这道ACCA F5试题作答的时候可以先从公司整体经营状况的角度出发,总体分析收入和成本变动情况。接下来分析每个业务模块业绩表现。下面是官方给出的标准答案,大家可以参考学习。

Sales volumes

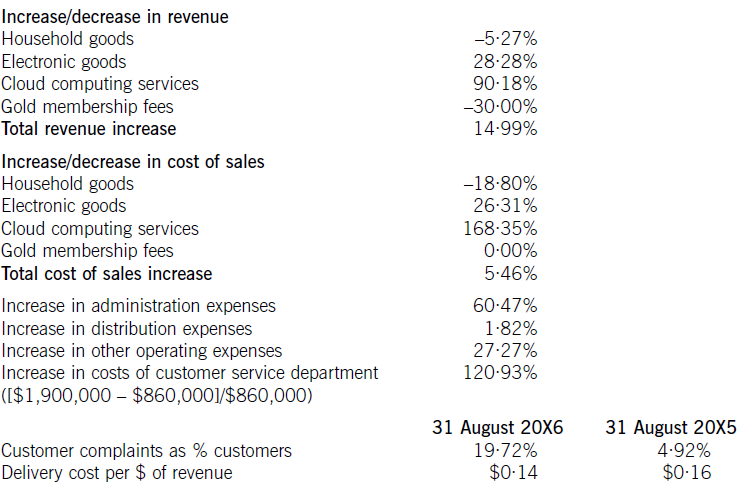

Since prices have remained stable year on year, it can be assumed that changes to revenue are as a result of increases or decreases in sales volumes. Overall, revenue has increased by 15%, which is a substantial increase. In order to understand what has happened in the business, it is necessary to consider sales by looking at each of the different categories.

Household goods

Although this was the largest category of sales for Jungle Co last year, this year it has decreased by 5% and has now been overtaken by electronic goods. The company changed suppliers for many of its household goods during the year, buying them instead from a country where labour was cheap. It may be that this has affected the quality of the goods, thus leading to decreased demand.

Electronic goods

Unlike household goods, demand for electronic goods from Jungle Co has increased dramatically by 28%. This is now Jungle Co’s leading revenue generator. This is partly due to the fact that the electronic goods market has grown by 20% worldwide. However, Jungle Co has even outperformed this, meaning that it has secured a larger segment of the market.

Cloud computing service

This area of Jungle Co’s business is growing rapidly, with the company seeing a 90% increase in this revenue stream in the last year. Once again, the company has outperformed the market, where the average growth rate is only 50%, suggesting that the investment in the cloud technology was worthwhile.

Gold membership fees

This area of the business is relatively small but has shrunk further, with a decrease in revenue of 30%. This may be because customers are dissatisfied with the service that they are receiving. The number of late deliveries for Gold members has increased from 2% to 14% since Jungle Co began using its own logistics company. This has probably been at least partly responsible for the massive increase in the number of customer complaints.

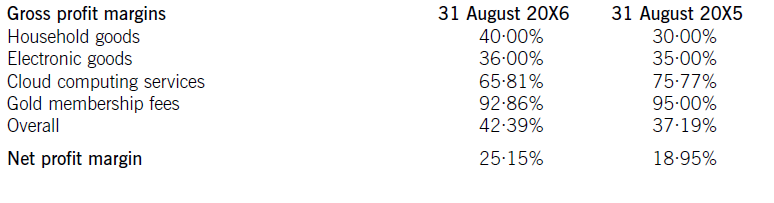

Gross profit margins

Overall, the company’s gross profit margin (GPM) has increased from 37% to 42%. Whilst the GPM for electronic goods has only increased by 1 percentage point, the margin for household goods has increased by 10 percentage points. This is therefore largely responsible for the increase in overall GPM. This has presumably occurred because Jungle Co is now sourcing these products from new, cheaper suppliers.

Gold membership fees constitute only a small part of Jungle Co’s income, so their 2 percentage point fall in GPM has had little impact on the overall increase in GPM. Cloud computing services, on the other hand, now make up over $12m of Jungle Co’s sales revenue. For some reason, the GPM on these sales has fallen from 76% to 66%. This is now 14 percentage points less than the market average gross profit margin of 80%. More information is needed to establish why this has happened. It has prevented the overall increase in GPM being higher than it otherwise would have been.

Administration expenses/customer complaints

These have increased by 60% from $1·72m to $2·76m. This is a substantial increase. The costs of the customer service department are in here. Given the number of late deliveries increase from 2% to 14%, and the corresponding increase in customer complaints from 5% to 20%, it is not surprising that the administration costs have increased. As well as being concerned about the impact on profit of this increase of over $1m, Jungle Co should be extremely worried about the effect on its reputation. Bad publicity about reliable delivery could affect future business.

Distribution costs

Despite an increase in sales volumes of 15%, distribution expenses have increased by less than 2 percentage points. They have gone down from $0·16 to $0·14 per $ of revenue. Although this means that Jungle Co has been successful in terms of saving costs, as discussed above, the damage which late deliveries are doing to the business cannot be ignored. The company needs to urgently address the issue of late deliveries.

Net profit margin

This has increased from 19% to 25%. This means that, all in all, Jungle Co has had a successful year, with net profit having increased from $15·6m to $23·8m. However, the business must address its delivery issues if its success is to continue.

精品好课免费试听