转移定价(transfer price)知识点在ACCA历年考试中频率很高。一般来说,简单的考核方式会给出一些条件让考生判断产品的外部需求是否已经满足,工厂是否已经满负荷运转,这些情况下应该选用可变成本还是市场价格来定价。做这类题目的时候需要从集团利益的角度的出发,考虑部门之间应该采取内部购销还是各自从外部购入或对外销售。总之,做出的决策和制定的价格既要满足集团的利益又不能影响各部门的绩效考评。下面我们来看一下2011年12月Q2这道例题,虽然年份比较久远,但是非常经典,难度也比较大,可以说考出了F5绩效管理的精髓。

Bath Co is a company specialising in the manufacture and sale of baths. Each bath consists of a main unit plus a set of bath fittings. The company is split into two divisions, A and B. Division A manufactures the bath and Division B manufactures sets of bath fittings. Currently, all of Division A’s sales are made externally. Division B, however, sells to Division A as well as to external customers. Both of the divisions are profit centres.

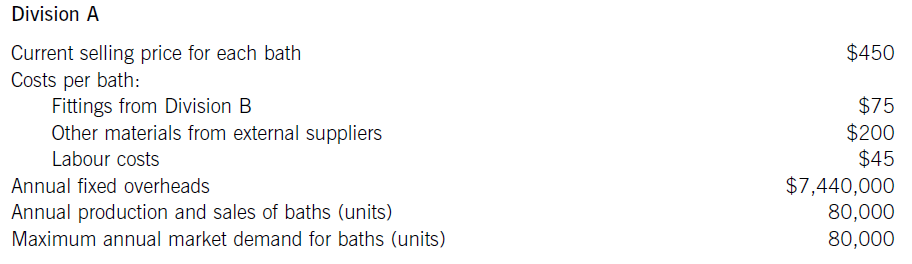

The following data is available for both divisions:

The transfer price charged by Division B to Division A was negotiated some years ago between the previous divisional managers, who have now both been replaced by new managers. Head Office only allows Division A to purchase its fittings from Division B, although the new manager of Division A believes that he could obtain fittings of the same quality and appearance for $65 per set, if he was given the autonomy to purchase from outside the company. Division B makes no cost savings from supplying internally to Division A rather than selling externally.

Required:

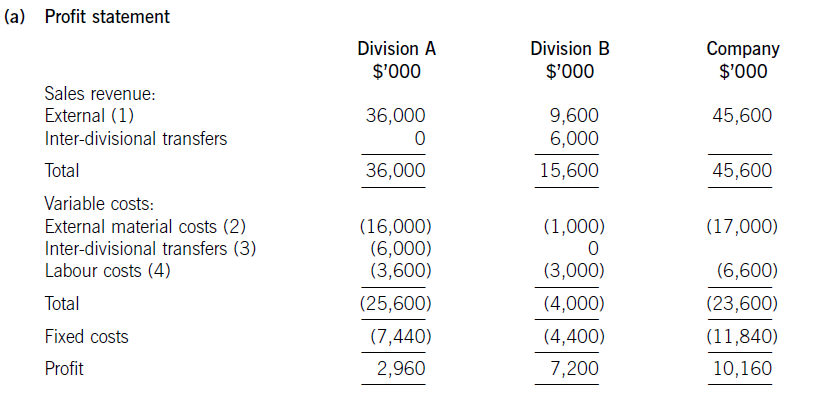

(a) Under the current transfer pricing system, prepare a profit statement showing the profit for each of the divisions and for Bath Co as a whole. Your sales and costs figures should be split into external sales and inter-divisional transfers, where appropriate. (6 marks)

(b) Head Office is considering changing the transfer pricing policy to ensure maximisation of company profits without demotivating either of the divisional managers. Division A will be given autonomy to buy from external suppliers and Division B to supply external customers in priority to supplying to Division A.

Calculate the maximum profit that could be earned by Bath Co if transfer pricing is optimised. (8 marks)

(c) Discuss the issues of encouraging divisional managers to take decisions in the interests of the company as a whole, where transfer pricing is used. Provide a reasoned recommendation of a policy Bath Co should adopt.

答案解析

首先,我们要明确题目中部门A和B分别代表什么角色。B是生产产品所用辅料的一方,A需要采购辅料来生产主要产品然后对外销售。B部门既销售给A又对外部销售。浏览题干是,我们需要注意Division A 数据中的Fitting from Division B 75美元这个金额,它对B来说是销售收入,而对A是采购成本。Division B 的对外销售金额80。另一个重要信息点是Maximum annual production and sales of sets of fittings (units) 200,000,Maximum annual external demand for sets of fittings (units) 180,000,Maximum annual internal demand for sets of fittings (units) 80,000。这句话的意思是满足内外部总需求的产能是200,000个单位。A部门需求80,000,而外部需求是180,000,我们需要考虑先对外销售还是内部转移。如果优先满足内部需求80,000,那么只能对外销售120,000;如果先满足外部需求180,000,那么内部只能供应20,000。

接下来我们先看一下官方给出的答案:

Workings ($’000)

(1) External sales

Div A: 80,000 x $450 = $36,000

Div B: 120,000 x $80 = $9,600

Div B: 80,000 x $75 = $6,000

题目中给出的信息是优先满足内部需求,所以先销售80,000给A部门,收入是80,000 x $75 = $6,000。剩下的产能(200,000-80,000=120,000)分配给外部市场,赚取的收入为120,000 x $80 = $9,600

(2) External material costs

Div A: 80,000 x $200 = $16,000

Div B: 200,000 x $5 = $1,000

(3) Inter-divisional transfers

Div A: 80,000 x $75 = $6,000

(4) Labour costs

Div A: 80,000 x $45 = $3,600

Div B: 200,000 x $15 = $3,000

网校为广大学生提供免考科目预评估服务,您可以点击![]() 进行评估申请。

进行评估申请。

关注“ACCA考试辅导”微信公众号,获取更多讯息

精品好课免费试听