Worked example

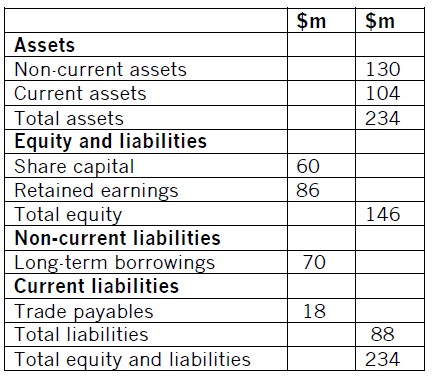

The following forecast financial position statement as at 31 May 2012 refers to

Refgun Co, a stock exchange-listed company, which is seeking to spend $90m in cash on a permanent expansion of its existing trade.

The forecast results for Refgun Co, assuming the expansion occurs from

1 June 2012, are as follows:

Notes:

1. The long-term borrowings are 8% bonds that were issued in 1996 with a

20-year term

2. The current assets include $18m of cash, of which $15m is held on deposit

3. Refgun Co has consistently grown its profits and dividends in real terms

4. No new finance has been raised in recent years

5. The sector average financial gearing (debt/equity on a book value basis) is currently 85%

6. The sector average interest cover is currently 2.9 times

7. The company estimates that it could borrow at a pre-tax rate of 7.2% per year

8. The company pays tax on its pre-tax profits at a rate of 28%

Required:Recommend a suitable method of raising the finance required by Refgun Co, supporting your evaluation with both analysis and critical discussion.

Prior to reading the suggested solution students should carry out their own evaluation of the forecast financial performance and the current and forecast financial position. A consideration of the factors discussed earlier should lead students to a justified recommendation.

Suggested solution

Refgun Co is seeking to spend $90m on a permanent expansion of its existing trade. It should be noted that the company has significant retained earnings,

$15m of which is held in cash on deposit. This could presumably be used to help fund the expansion and, if this is the case, the need for additional finance would be reduced to $75m. However, the company may have a reason for holding cash – for example, to meet budgeted cash payments in the near future.

Forecast financial performance

The forecast financial performance of Refgun Co will be a key consideration to potential finance providers. Analysis of the forecast performance of Refgun Co gives the following information:

Geometric average growth in turnover = (98.6/71.7)(1/3) – 1 = 11.2%

Geometric average growth in operating profit = (37.1/24.4)(1/3) – 1 = 15.0%

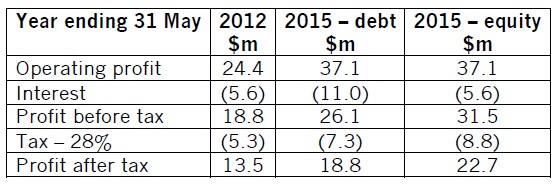

The forecast income statements for the years ending 31 May 2012 and 2015 are shown below. Two income statements have been prepared for 2015, one assuming the expansion is funded by debt and the other assuming the expansion is funded by equity:

The interest charge for 2012 is assumed to be (70 x 8%) = $5.6m

If debt finance is used the interest charge from 2013 onwards is assumed to be (70 x 8%) + (75 x 7.2%) = $11.0m

Note: While it would be good to forecast the income statement for each year, time pressure may mean this is not possible.

This analysis shows that the growth in revenue caused by the expansion is exceeded by the growth in operating profit due to a steady rise in the operating margin of the company. This may be a result of the company benefiting from economies of scale as a result of the expansion. Whether debt finance or equity finance is used, both the returns to all investors (operating profit) and the return to the equity investors (profit after tax) both show considerable growth.

Current and forecast financial position

The gearing (D/E) is currently 70/146 = 47.9% on a book value basis. If debt finance is raised this would rise to (70+75)/146 = 99.3%, while if equity finance was used it would fall to 70/(146+75) = 31.7%. Even if debt finance was raised the gearing level would rapidly fall again as the company makes and retains profits.

The interest cover is currently 24.4/5.6 = 4.4 times. If debt finance is used then this would fall to 28.5/11.0 = 2.6 times in 2013. However, by 2015 it would have recovered to 37.1/11.0 = 3.4 times. If equity finance were to be used the interest cover would consistently improve.

Refgun Co currently has less financial risk than the sector average and the financial risk would decline even further if equity finance was used. If debt finance is used then the financial risk would initially rise slightly above the sector average but would soon return to the sector average level or below.

Factors that Refgun Co should consider prior to choosing a financing method

Cost and cash flows – Refgun Co would seem to have the capacity to raise more debt as the non-current assets exceed the existing debt by $60m.

Furthermore, the company seems to be cash-generative in that it is currently holding $15m on deposit, despite not having raised any finance for several years. Hence, the company may be wise to take advantage of cheaper debt.

Risk – As the company is expanding its existing trade there should be no material change in business risk. If debt finance is chosen the directors should ensure that the shareholders are happy with the extra financial risk. Given the analysis above, this seems likely.

Security and covenants – As long as the expansion involves investing in some non-current assets there should be sufficient security available for potential lenders. The company should check what potential covenants might be imposed and ensure that they would be happy to live with them.

Availability and maturity – Given the recent performance and the good forecasts, the company is likely to have many finance sources available to it.

Debt providers should be willing to lend and shareholders would be likely to support a rights issue. Equally, other investors may well wish to invest in the equity of the company. As the finance is required to finance a permanent expansion of the company, long-term finance should be raised. To the extent that the expansion requires investment in additional working capital, some short-term finance could be raised. Consideration should also be given to the fact that the existing bonds of the company are due to be repaid in 2016.

Subject to early redemption penalties, it may be worth looking into refinancing this debt at the same time as raising the new debt especially as the cost of new debt appears lower.

Control – If debt is issued, no change would occur to control. A rights issue would also have little impact on control while the issue of shares to new investors may cause control issues.

Costs and ease of issue – A debt issue is likely to be cheaper and easier than an equity issue and, hence, may well be favoured by the directors.

Yield curve – The directors of Refgun Co should consider the yield curve if it is decided to raise debt.

Recommendation of a suitable financing method

From the analysis and discussion above, it would seem that Refgun Co should seek to finance the expansion by raising long-term debt secured on the existing non-current assets of the company and the new non-current assets acquired during the expansion. At the same time as raising the new debt, the refinancing of the existing debt should also be considered. If shareholders and other key stakeholders are concerned about the financial risk exceeding the industry average, then Refgun Co could raise some short-term debt with the aim of repaying it as soon as more cash is earned. The impact on gearing could also be reduced by acquiring some assets on operating leases, or by the sale and lease back of some existing assets. The directors should take action to manage the interest rate risk that Refgun Co will suffer.

I hope that this article has provided students with an approach that they can use when answering a question of this nature. All too often students have a feel for the type of finance that may be suitable for a company, but cannot support or justify what they are proposing and, hence, cannot earn the marks that are available.

William Parrott is a lecturer at Kaplan Financial

Page: 1 2 >> See the original>>

精品好课免费试听