Example 3: Accounting for a financial liability at amortised cost

Broad raises finance by issuing $20,000 6% four-year loan notes on the first day of

the current accounting period. The loan notes are issued at a discount of 10%, and

will be redeemed after three years at a premium of $1,015. The effective rate of

interest is 12%. The issue costs were $1,000.

Required

Explain and illustrate how the loan is accounted for in the financial statements of

Broad.

Solution

Broad is receiving cash that is obliged to repay, so this financial instrument is

classified as a financial liability. Again, as is perfectly normal, the liability will be

classified and accounted for at amortised cost and, thus, initially measured at the fair

value of consideration received less the transaction costs.

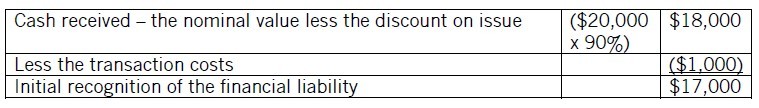

With both a discount on issue and transaction costs, the first step is to calculate the

initial measurement of the liability.

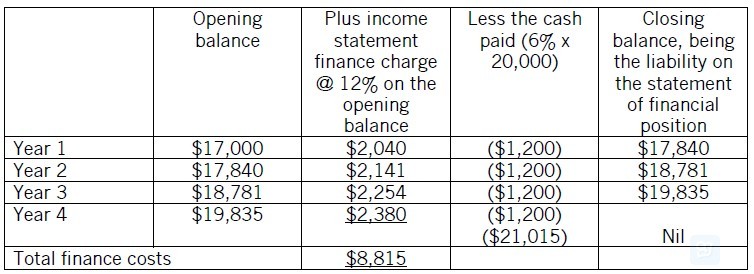

In applying amortised cost, the finance cost to be charged to the income statement is

calculated by applying the effective rate of interest (in this example 12%) to the

opening balance of the liability each year. The finance cost will increase the liability.

The actual cash is paid at the end of the reporting period and is calculated by

applying the coupon rate (in this example 6%) to the nominal value of the liability (in

this example $20,000). The annual cash payment of $1,200 (6% x $20,000 = $1,200)

will reduce the liability. In the final year there is an additional cash payment of

$21,015 (the nominal value of $20,000 plus the premium of $1,015), which

extinguishes the remaining balance of the liability. The workings for the liability being

accounted for at amortised cost can be summarised and presented as follows.

Because the cash paid each year is less than the finance cost, each year the

outstanding liability grows and for this reason the finance cost increases year on year

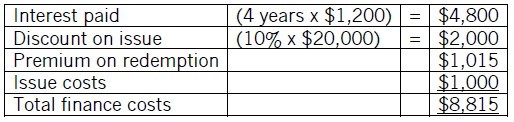

as well. The total finance cost charged to income over the period of the loan

comprises not only the interest paid, but also the discount on the issue, the premium

on redemption and the transaction costs.

Financial liabilities at FVTPL

Financial liabilities are only classified as FVTPL if they are held for trading or the

entity so chooses. This is unusual and only examinable in Paper P2. The option to

designate a financial liability as measured at FVTPL will be made if, in doing so, it

significantly reduces an ‘accounting mismatch’ that would otherwise arise from

measuring assets or liabilities or recognising the gains and losses on them on

different bases, or if the liability is part or a group of financial liabilities or financial

assets and financial liabilities that is managed and its performance is evaluated on a

fair value basis, in accordance with an investment strategy. In addition, a financial

liability may still be designated as measured at FVTPL when it contains one or more

embedded derivatives that would require separation.

Financial liabilities that are classified as FVTPL are initially measured at fair value and

any transaction costs are immediately written off to the income statement.

By accounting for a financial liability at FVTPL, the financial liability is also increased

by a finance cost and reduced by cash repaid but is then revalued at each reporting

date with any gains and losses immediately recognised in the income statement. The

measurement of the new fair value at the year end will be its market value or, if not

known, the present value of the future cash flows, using the current market interest

rates. The interest rate used subsequently to calculate the finance cost will be this

new current rate until the next revaluation.

Example 4: Accounting for a financial liability at FVTPL

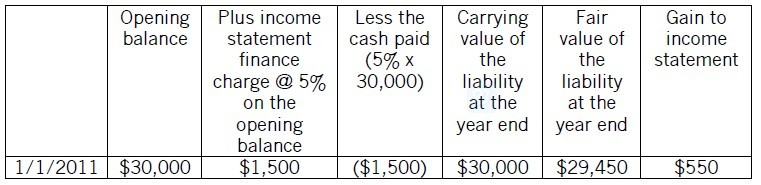

On 1 January 2011 Swann issued three year 5% $30,000 loans notes at nominal value when the effective rate of interest is also 5%. The loan notes will be redeemed at par. The liability is classified at FVTPL. At the end of the first accounting period market interest rates have risen to 6%.

Required

Explain and illustrate how the loan is accounted for in the financial statements of

Swann in the year ended 31 December 2011.

Solution

Swann is receiving cash that is obliged to repay so this financial instrument is

classified as a financial liability. The liability is classified at FVTPL so, presumably, it

is being held for trading purposes or the option to have it classified as FVTPL has

been made.

Initial measurement is at the fair value of $30,000 received and, although there are no

transaction costs in this example, these would be expensed rather than taken into

account in arriving at the initial measurement.

With an effective rate of interest and the coupon rate both being 5%, at the end of the

accounting period the carrying value of the liability will still be $30,000. This is

because the finance cost that will increase the liability is $1,500 (5% x $30,000 – the

effective rate applied to the opening balance), and the cash paid reducing the liability

is also $1,500 (5% x $30,000 – the coupon rate applied to the nominal value).

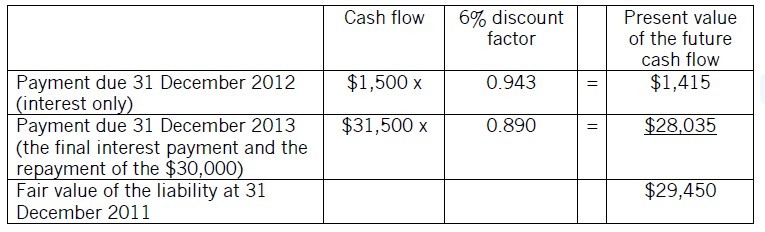

As the liability has been classified as FVTPL this carrying value at 31 December 2011

now has to be revalued. The fair value of the liability at this date will be the present

value (using the new rate of interest of 6%) of the next remaining two years' payments.

As Swann has classified this liability as FVTPL, it is revalued to $29,450. The

reduction of $550 in the carrying value of the liability from $30,000 is regarded as a

profit, and this is recognised in the income statement. If, however, the higher discount

rate used was not because general interest rates have risen, rather the credit risk of

the entity has risen, then the gain is recognised in other comprehensive income. This

can all be summarised in the following presentation.

We can briefly consider the accounting in the remaining two years. The finance charge in the income statement for the year end 31 December 2012 will be the 6% x $29,450 = $1,767, and with the cash payment of $1,500 being made, the carrying value of the liability will be $29,717 ($29,450 plus $1,767 less $1,500) at the year end.

If at 31 December 2012 the market rate of interest has fallen to, say, 4%, then the fair

value of the liability at the reporting date will be the present value of the last

repayment due of $31,500 in one year's time discounted at 4% (ie $31,500 x 0.962 =

$30,288), which in turn means that as the fair value of the liability exceeds the

carrying value, a loss of $571 (ie $30,288 less $29,717) arises which is recognised in

the income statement.

In the final year ending 31 December 2013 the finance cost to the income statement

will be 4% x $30,288 = $1,212, increasing the liability to $31,500 before the final

cash payment of $31,500 is made, thus extinguishing the liability. As you may know

from your financial management studies, and as is demonstrated here, when interest

rates rise so the fair value of bonds fall and when interest rates fall then the fair value

of bonds rises.

The next article will consider the accounting for convertible bonds and financial

assets.

Tom Clendon FCCA is a senior tutor at Kaplan Financial, London

Page: 1 2 See the original article>>

精品好课免费试听