EXAMPLE 1

ABC Partnership

Table 1 shows the appropriation account for the year ended 31 December 2005. In an exam, the examiner might include the partners’ salary as wages and salaries in the income statement/profit and loss account. This would mean that the net profit would need adjusting, which would involve adding the partners’ salary to the net profit given in the question.

EXAMPLE 2

ABC Partnership

Table 2 shows the current account as at 31 December 2005.

EXAMPLE 3

ABC Partnership

Table 3 shows the capital account as at 31 December 2005.

EXAMPLE 4

Here is an illustrated example of the workings of a partnership business, and the treatment of goodwill on the admission of a new partner.

Jess and Tash are in partnership and share profits and losses in the ratio of 6:4 respectively. Jess is allowed an annual salary of $28,000 and Tash is allowed an annual salary of $25,000. The partners prepare their accounts annually at 31 December. The balances on the partners’ current and capital accounts at 1 January 2005 are as follows:

Due to the expansion and success of the business, the partners admitted Sash into the partnership on 1 April 2005. Sash introduced $500,000 as capital. On that date, the partners valued the goodwill as $200,000. After the admission of Sash, the partnership arrangements are as follows:

Profit and losses will be shared as follows:

– Jess: 50%

– Tash: 30%

– Sash: 20%

Partners will be credited with 5% of the interest on their capital balance at the start of the year

Interest on drawings will be charged at 8% per annum

The partners’ drawings during the year are as follows:

– Jess: $40,000 to 31 March and $60,000 to 31 December

– Tash: $30,000 to 31 March and $50,000 to 31 December

– Sash: $50,000 to 31 December

Sash will be allowed an annual salary of $20,000. Jess and Tash will continue to receive their annual salary

The goodwill must be eliminated from the records

During the year ended 31 December 2005, the partnership reported a profit of $526,000 after writing off a bad debt of $6,000 on 31 March 2006

The partners’ annual salary was deducted as an expense in the income statement/profit and loss account under wages and salaries.

Requirement

Prepare the following:

(a) Partners’ capital accounts as at 31 March 2005

(b) Partners’ appropriation account for the year ended 31 December 2005

(c) Partners’ current accounts as at 31 December 2005

(d) Balance sheet extract (Capital) as at 31 December 2005.

Answer

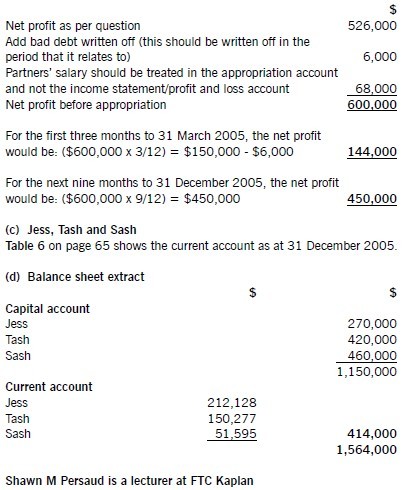

(a) Jess, Tash and Sash Partnership

Table 4 on page 65 shows the capital account as at 31 March 2005.

Goodwill is the excess market value of the business over its book value. It is only fair that the partners who created this goodwill – Jess and Tash

– should benefit from it, due to the hard work they have put into the business to get it up and running. If a partner joins the business when such surplus is present, then it is only fair that Sash pays for that benefit. The accounting entries are:

Dr Partners’ capital account using new profit sharing ratio (PSR)

Cr Partners’ capital account using old profit sharing ratio (PSR).

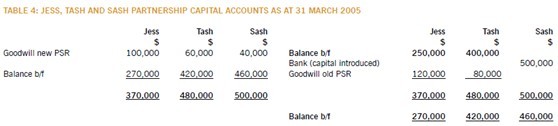

(b) Jess, Tash and Sash

Table 5 on page 65 shows the appropriation account for the year ended 31 December 2005.

Calculating the profit

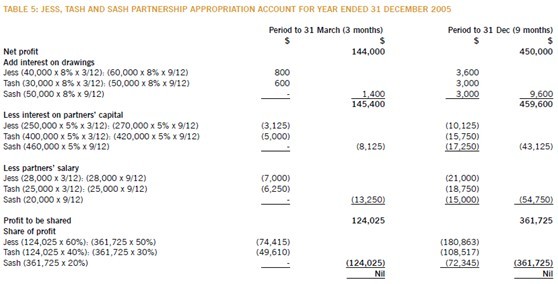

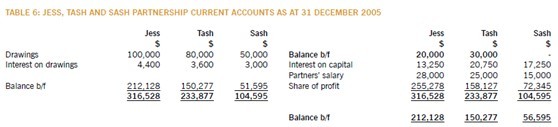

In order to prepare the capital part of the balance sheet for a partnership, there are three workings that must be completed: partners’ appropriation account, partners’ current account, and partners’ capital account.

Page:1 2 See the original article>>

精品好课免费试听