Although 2011 saw a number of new accounting standards issued in respect of groups, throughout 2012 the Paper F3/FFA syllabus still continues to examine the principles contained in:

· IAS 27, Consolidated and Separate Financial Statements

· IAS 28, Investments in Associates

· IFRS 3, Business Combinations

From December 2011, Paper F3/FFA saw two main new examinable areas added to its syllabus – the preparation of simple consolidated financial statements and the interpretation of financial statements.

This article focuses on some of the main principles of consolidated financial statements that a candidate must be able to understand and gives examples of how they may be tested in multiple-choice questions (MCQs).

It does not attempt to cover every technical aspect of consolidation, but to give candidates the tools they need to prepare for the style and level of testing, they can expect to see in this paper.

(1) How is a parent-subsidiary relationship identified? IAS 27 defines consolidated financial statements as ‘the financial statements of a group presented as those of a single economic entity.’ A group is made up of a parent and its subsidiary.

Illustration 1 shows an example of a typical group structure.

The illustration shows how a parent company has control over a subsidiary. At Paper F3 level, it is assumed that control exists if the parent company has more than 50% of the ordinary (equity) shares – ie giving them more than 50% of the voting power.

However, there are examples where a holding of less than 50% of the ordinary shares can still lead to control existing. This may be because the parent has:

· the power over more than 50% of the voting rights by virtue of agreement with other investors

· the power to govern the financial and operating policies of the entity under statute or an agreement

· the power to appoint or remove the majority of the members of the board of directors, or

· the power to cast the majority of the votes at meetings of the board of directors.

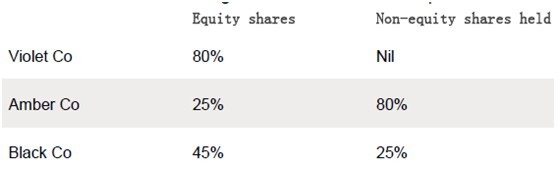

A typical MCQ may describe a number of different investments and you would need to decide if they are subsidiaries – ie if control exists. Illustration 2 is an example of a typical question.

Illustration (2) Green Co owns the following investments in other companies:

Green Co also has appointed five of the seven directors of Black Co.

Which of the following investments are accounted for as subsidiaries in the consolidated accounts of Green Co Group?

A Violet only

B Amber only

C Violet and Black

D All of them

Answer

Let’s consider each of the investments in turn to determine if control exists and, therefore, if they should be accounted for as a subsidiary.

· Violet Co – by looking at the equity shares, Green Co has more than 50% of the voting shares – ie an 80% equity holding. This gives them control and, therefore, Violet Co is a subsidiary.

· Amber Co – you must remember to look at the equity shares, as despite having the majority of the non-equity shares, these do not give voting power. As Green Co only has 25% of the equity shares, they do not have control and, therefore, Amber Co is not a subsidiary.

· Black Co – by looking at the percentage of equity shares, you may incorrectly conclude that Black Co is not a subsidiary, as Green Co has less than half of the voting rights. However, by looking at the fact that Green Co has appointed five of

the seven directors, effectively they have control over the decision making in the company. This control should make you conclude that Black Co is a subsidiary.

Therefore the correct answer is C.

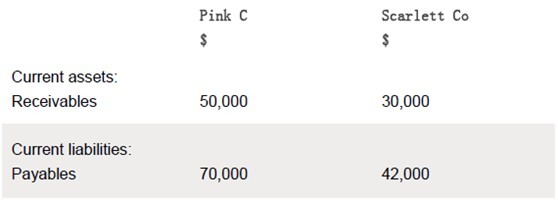

Illustration (3) Pink Co acquired 80% of Scarlett’s Co ordinary share capital on 1 January 2012.

As at 31 December 2012, extracts from their individual statements of financial position showed:

As a result of trading during the year, Pink Co’s receivables balance included an amount due from Scarlett of $4,600.

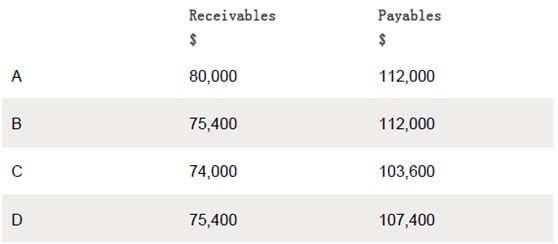

What should be shown as the consolidated figure for receivables and payables?

Answer

From the question, we can see that Pink Co has control over Scarlett Co. This should mean that you immediately consider adding together 100% of Pink Co’s balances and Scarlett Co’s balances to reflect control.

However, the intra-group balances at the year end need to be eliminated, as the consolidated accounts need to show the group as a single economic entity – in other words, the group position with the outside world.

As Pink Co shows a receivable of $4,600, then in Scarlett Co’s individual accounts there must be a corresponding payable of $4,600. When these balances are eliminated, the consolidated figures become:

Receivables ($50,000 + $30,000 – $4,600) = $75,400

Payables ($70,000 + $42,000 – $4,600) = $107,400

Therefore, the correct answer is D, not A which completely omits the elimination of the intra-group balances, nor answer B which omits to cancel the corresponding payable within liabilities.

You would not select answer C, which incorrectly adds 100% of Pink Co (the parent) and only 80% of Scarlett Co (the subsidiary).

(3) Adjustments for unrealised profits

Another common adjustment that you could be asked to deal with is the removal of unrealised profit. This arises when profits are made on intra-group trading and the related inventories have not subsequently been sold to customers outside the group.

The following illustration demonstrates this in the context of the consolidated income statement.

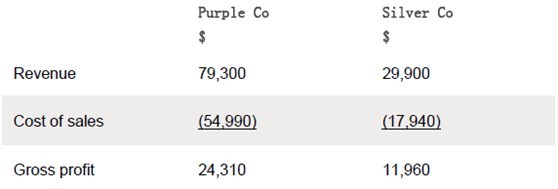

Illustration (4) Purple Co acquired 70% of the voting share capital of Silver Co on 1 October 2011.

The following extracts are from the individual income statements of the two companies for the year ended 30 September 2012:

Purple Co had made sales to Silver Co during the year of $5,000. Purple Co had originally purchased the goods at a cost of $4,000. Half of these items remained in inventory at the year end.

What should be the consolidated revenue for the year ended 30 September 2012?

A $104,700 B $95,230 C $108,700 D $104,200

Answer

Even though this question requires an extract from the consolidated income statement, the principle is still the same as Illustration (3) – consolidate the group as if it is a single economic entity by adding in 100% line by line, and showing group performance with the outside world.

Therefore, answer B would not be selected as it incorrectly adds 100% of Purple Co and only 70% of Silver Co.

The other adjustment that requires careful consideration is the intra-group trading. In the consolidated income statement we must always consider two steps:

· Has there been any intra-group trading during the year, irrespective of whether the goods are included in inventory?

· Do any of the items remain in inventory at the end of the year?

In this question, $5,000 of sales have been made from Purple Co selling to Silver Co. This must be eliminated, irrespective of whether the items remain unsold at the year end. This is because the consolidated income statement needs to show revenue (and costs of sales) and, therefore, performance with the outside world.

The second step here is to identify the provision for unrealised profit. Purple Co has made a profit of $1,000 (calculated as revenue of $5,000 – cost of $4,000). As only half of the items remain in inventory, their value is overstated by half of that profit – that is, $500. Note: in many Paper F3 questions, you will be expected to calculate the profit made by using margins or mark-ups, which are not discussed here.)

The consolidation adjustment, in effect, is saying that the group has made a profit of $500 on items, which have not been sold on to a third party – so effectively selling inventory at a profit to itself, therefore inflating the value of the inventory held by the group in the statement of position and the profit in the income statement.

The adjustment would be:

Cr. Inventory (CSOFP) $500

Dr. Cost of sales $500

However, by reading the question stem carefully, you will see that eliminating the unrealised profit is a red herring, as we are being asked for consolidated revenue.

Therefore, the consolidated revenue is calculated as:

$79,300 + $29,900 – $5000 = $104,200

The correct answer is D.

Had the question stem asked for the consolidated cost of sales figure, the answer would be correctly calculated as:

$54,990 + $17,940 + $500 – $5,000 = $68,430

Note: Answer A is incorrect, as although it correctly cancels the intra-group sale of $5,000, it incorrectly adds the $500 adjustment for unrealised profit to the revenue figure ($79,300 + $29,900 – $5,000 + $500 = $104,700)

Answer C is also incorrect because it omits the cancelling of $5,000 sales and deals incorrectly with the provision for unrealised profit of $500. ($79,300 + $29,900 – $500 = $108,700).

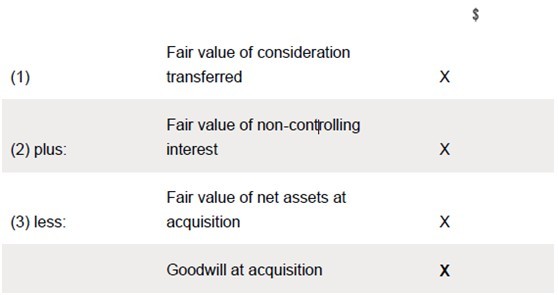

(4) How is goodwill calculated?

Another typical Paper F3 question will require you to calculate goodwill.

Under this syllabus, only the full goodwill method is examinable and is calculated as:

Even though we only own 80% of the share capital, the full goodwill method brings 100% of the goodwill on to the consolidated statement of financial position. This is consistent with the treatment of other assets and the concept of control. This is why we need to include the fair value of the non-controlling interest in our goodwill calculation. See Illustration 5 below for a typical MCQ on goodwill.

精品好课免费试听