This article is relevant to candidates sitting Paper F6 (UK) in either June or December 2013, and is based on tax legislation as it applies to the tax year 2012–13 (Finance Act 2012).

Overseas aspects of corporation tax may be examined as part of Question 2, or it could be examined in Questions 4 or 5.

Company residence

Companies that are incorporated in the UK are resident in the UK. Companies that are incorporated overseas are only treated as being resident in the UK if their central management and control is exercised in the UK. Companies that are resident in the UK (or treated as being resident in the UK) are subject to UK corporation tax on their worldwide profits (including chargeable gains).

Example 1 Crash-Bash Ltd is incorporated overseas, although its directors are based in the UK and hold their board meetings in the UK.

· Companies that are incorporated overseas are only treated as being resident in the UK if their central management and control is exercised in the UK.

· Since the directors are UK based and hold their board meetings in the UK, this would indicate that Crash-Bash Ltd is managed and controlled from the UK, and therefore it is resident in the UK.

· If the directors were to be based overseas and to hold their board meetings overseas, the company would probably be treated as resident overseas since the central management and control would then be exercised outside the UK.

Overseas dividends

As far as Paper F6 (UK) is concerned all overseas dividends are exempt from UK corporation tax.

Exempt overseas dividends are included as franked investment income when calculating a company’s augmented profits in exactly the same way as UK dividends, unless they are group income. In this case they are completely ignored for tax purposes.

Example 2

During the year ended 31 March 2013 Various Ltd, a UK resident company, received an overseas dividend of £67,500 (net). Withholding tax was withheld from the dividend at the rate of 15%.

· If Various Ltd owns 50% or less of the voting power of the overseas company, then the overseas dividend will be exempt from UK corporation tax but included as

· If Various Ltd owns more than 50% of the voting power of the overseas company, then the dividend will be exempt from UK corporation tax and not included as franked investment income. This is because the overseas dividend is group income.

Overseas branches

An overseas branch of a UK company is effectively an extension of the UK trade, and 100% of the branch profits are assessed to UK corporation tax. Double taxation relief is then given where an overseas branch’s profits are also taxed overseas. Relief is restricted to the amount of UK tax on the overseas branch’s profits. If an overseas branch makes a trading loss then the loss can be relieved against UK profits.

Example 3

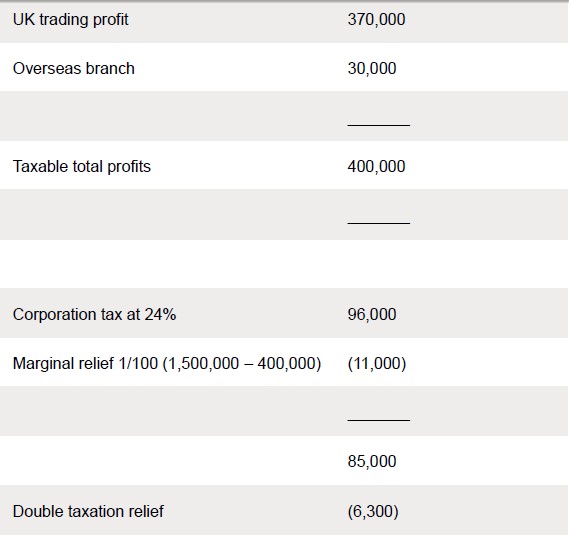

Gong Ltd is a UK resident company with an overseas branch. For the year ended 31 March 2013 the company made a trading profit of £370,000, and the branch made a trading profit of £30,000. Overseas corporation tax of £6,300 was paid in respect of the overseas branch’s trading profit.

Gong Ltd’s corporation tax liability for the year ended 31 March 2013 is as follows:

The overseas branch has paid overseas corporation tax of £6,300, and this is lower than the related UK corporation tax of £6,375 (85,000 x 30,000/400,000).

As an alternative to this treatment it is possible for a company to elect to simply treat the profits of all of its overseas branches as being exempt from UK corporation tax. The election, once made, is irrevocable, and it applies to all of a company’s overseas branches. The election must be made before the start of an accounting period to which it is to apply.

An election will not be beneficial if a company has a loss making overseas branch, since if an election is made any trading loss of an overseas branch will not be relievable when calculating taxable total profits. Even if a branch is currently profitable, a company might decide not to make an election if double taxation relief means there is little or no UK corporation tax liability in respect of the branch profits. This will mean that relief will then be available should the branch make a loss at some point in the future.

See more>> See the original article>>

精品好课免费试听