Example 4

Brown Ltd is a UK resident company with two overseas branches. For the year ended 31 March 2013 the company made a trading profit of £210,000. The first overseas branch made a trading profit of £40,000 for the year ended 31 March 2013. Overseas corporation tax of £6,000 was paid in respect of this profit. The second overseas branch made a trading loss of £25,000 for the year ended 31 March 2013. Brown Ltd has not made an election to exempt the profits of its overseas branches.

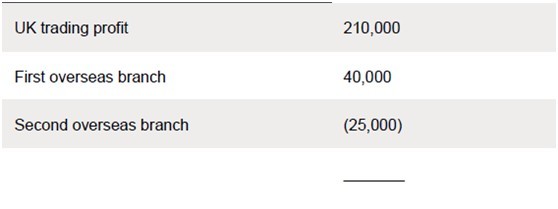

Brown Ltd’s corporation tax liability for the year ended 31 March 2013 is as follows:

The first overseas branch has paid overseas corporation tax of £6,000, and this is lower than the related UK corporation tax of £8,000 (40,000 at 20%).

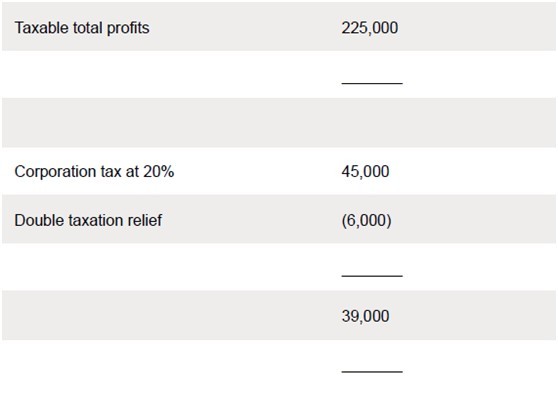

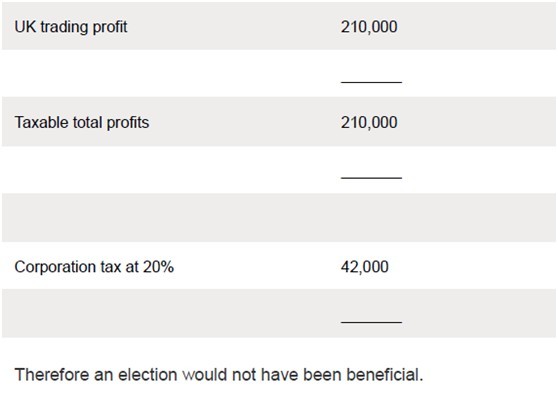

If Brown Ltd had made an election to exempt the profits of its overseas branches prior to 1 April 2012, then its corporation tax liability would have been as follows:

Overseas branch compared to an overseas subsidiary company It is important to appreciate the difference between operating overseas through a branch and operating overseas through a subsidiary company. An overseas branch of a UK company is effectively an extension of the UK trade, and (if no election for exemption is made) 100% of the branch profits are assessed to UK corporation tax. There are a number of factors that have to be considered when deciding whether to operate overseas through either a branch or a subsidiary company.

Example 5

Union Ltd is a UK resident company that is planning to set up an overseas operation. It is unsure whether to operate overseas through a branch or a 100% subsidiary company.

If no election for exemption is made

· Relief will usually be available for trading losses if incurred by an overseas branch. As far as Paper F6(UK) is concerned, no UK relief is available for trading losses incurred by an overseas subsidiary company.

· UK capital allowances will be available in respect of plant and machinery purchased by an overseas branch. Allowances will not be available for expenditure incurred by an overseas subsidiary company.

· The profits of an overseas branch are liable to UK corporation tax in the year that they are made, regardless of whether they are remitted to the UK. An overseas subsidiary company will not be liable to UK corporation tax.

· An overseas branch cannot be an associated company. An overseas subsidiary will be an associated company, and so the UK corporation tax limits will be reduced accordingly.

If an election for exemption is made

· As far as the calculation of taxable total profits is concerned, there will be no difference whether Union Ltd operates through an overseas branch or an overseas subsidiary company.

· However, the UK corporation tax liability could be higher as a result of operating through an overseas subsidiary company since this will be an associated company.

Transfer pricing

The transfer pricing rules prevent UK companies from reducing their taxable total profits subject to UK corporation tax by, for example, making sales at below market price to an overseas subsidiary company, or purchasing goods at above market price from an overseas holding company.

Example 6

Frodo Ltd, a UK resident company, exports goods that it has manufactured to its overseas subsidiary company at less than their market price.

· Invoicing for the exported goods at less than the market price will reduce Frodo Ltd’s UK trading profit and hence UK corporation tax.

· A true market price must therefore be substituted for the transfer price.

· The market price will be an ‘arms length’ one that would be charged if the parties to the transaction were independent of each other.

· Frodo Ltd will be required to make the adjustment in its corporation tax self-assessment tax return.

Conclusion

The overseas aspects of corporation tax, at Paper F6 (UK) level, are fairly straightforward provided you know the main principles involved. Working through the examples in this article should prepare you for anything that might be set in the examination.

Written by a member of the Paper F6 examining team

精品好课免费试听