Example 4

Sofa Ltd owns 100% of the ordinary share capital of both Settee Ltd and Futon Ltd. For the year ended 31 March 2013 Sofa Ltd had a trading loss of £200,000.

For the year ended 30 June 2012 Settee Ltd had taxable total profits of £240,000, and for the year ended 30 June 2013 will have taxable total profits of £90,000.

Futon Ltd commenced trading on 1 January 2013, and for the three-month period ended 31 March 2013 had taxable total profits of £60,000.

· The accounting periods of Settee Ltd and Sofa Ltd are not coterminous. Therefore, Settee Ltd’s taxable total profits and Sofa Ltd’s trading loss must be apportioned on a time basis.

· For the year ended 30 June 2012 group relief is restricted to a maximum of £50,000, being the lower of £60,000 (240,000 x 3/12) and £50,000 (200,000 x 3/12).

· For the year ended 30 June 2013 group relief is restricted to a maximum of £67,500, being the lower of £67,500 (90,000 x 9/12) and £150,000 (200,000 x 9/12).

· Futon Ltd did not commence trading until 1 January 2013, so group relief is restricted to a maximum of £50,000, being the lower of £60,000 and £50,000 (200,000 x 3/12).

As well as trading losses, it is possible to surrender unrelieved property business losses and qualifying charitable donations. Only current year losses can be group relieved, so no relief is available for trading losses brought forward from previous years.

In working out the taxable total profits against which group relief can be claimed, the claimant company is assumed to use any current year losses that it has, even if such a loss relief claim is not actually made.

Example 5

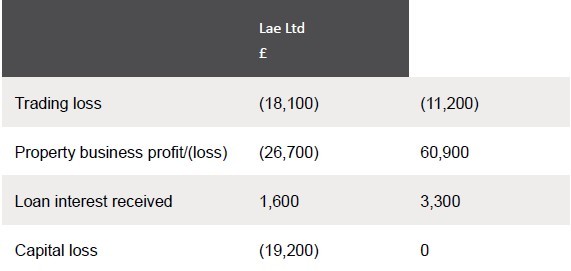

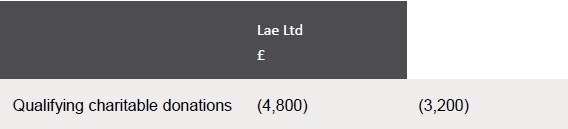

Lae Ltd owns 100% of the ordinary share capital of Mon Ltd. The results of each company for the year ended 31 March 2013 are as follows:

All the loan interest received is in respect of loans that were made for non-trading purposes.

Maximum claim by Mon Ltd

· The group relief claim by Mon Ltd is calculated after deducting qualifying charitable donations, and on the assumption that a claim is made for the current year trading loss.

· The maximum amount of group relief that can be claimed by Mon Ltd is therefore £49,800 (60,900 + 3,300 – 3,200 – 11,200).

Maximum surrender by Lae Ltd

· The property business loss and the qualifying charitable donations can be surrendered to the extent that they are unrelieved, so £29,900 of these can be surrendered (26,700 + 4,800 – 1,600).

· It is not possible to surrender capital losses as part of a group relief claim.

· The maximum potential surrender by Lae Ltd is £48,000 (18,100 + 29,900).

· The maximum group relief claim is therefore £48,000.

The most important factor to be taken into account when considering group relief claims is the rate of corporation tax payable by the claimant companies. Group relief should therefore be surrendered as follows:

· Initially to companies subject to corporation tax at the marginal rate of 25%.

· Surrender should then be to those companies subject to the main rate of corporation tax of 24%.

· The amount surrendered should be sufficient to bring the claimant company’s augmented profits down to the small profits rate limit.

· Any remaining loss should be surrendered to those companies subject to corporation tax at the small profits rate of 20%.

The loss making company may of course be able to relieve the loss itself. In this case consideration will also have to be given to the timing of the relief obtained (an earlier claim is generally preferable), and the extent to which relief for qualifying charitable donations will be lost.

Remember that unlike other loss relief claims, it is possible to specify the amount of group relief that is to be surrendered. The surrendering company can therefore restrict group relief so that it retains sufficient losses in order to bring its augmented profits down to the small profits rate limit.

Example 6

Colour Ltd owns 100% of the ordinary share capital of both Orange Ltd and Pink Ltd. The results of each company for the year ended 31 March 2013 are as follows:

· There are three associated companies in the group, so the lower and upper corporation tax limits are reduced to £100,000 (300,000/3) and £500,000 (1,500,000/3) respectively.

· Colour Ltd’s trading loss has been relieved so as to reduce both its own and Pink Ltd’s augmented profits down to the lower limit. Note that it is the augmented profits that are relevant, and not the taxable total profits.

· The balance of the loss has been surrendered to Orange Ltd as this saves corporation tax at the main rate of 24%.

Chargeable assets

It is important to remember that capital losses cannot be group relieved.

Example 7

Why would it be beneficial for all of the eligible companies in a chargeable gains group to transfer assets to one company prior to them being disposed of outside of the group?

· The transfers will not give rise to any chargeable gain or capital loss

· Arranging that wherever possible, chargeable gains and capital losses arise in the same company will result in the optimum use being made of capital losses.

· These can either be offset against chargeable gains of the same period, or carried forward against future chargeable gains.

However, an asset does not actually have to be moved between companies in order to match chargeable gains and capital losses. It is possible for two companies in a chargeable gains group to make a joint election so that matching is done on a notional basis.

The election has to be made within two years of the end of the accounting period in which the asset is disposed of outside the group, and will specify which company in the group is treated for tax purposes as making the disposal.

The advantages of the election compared to actually transferring an asset between group companies (prior to disposal outside of the group) are as follows:

· The two-year time limit for making an election means that tax planning regarding the set off of capital losses and chargeable gains can be done retrospectively.

· The two-year time limit also means that it is possible for chargeable gains to be treated as being made by the company in the group with the lowest rate of corporation tax.

Example 8

Rod Ltd owns 100% of the ordinary share capital of Stick Ltd. For the year ended 31 March 2013 Rod Ltd will pay corporation tax at the main rate of 24% while Stick Ltd will pay corporation tax at the small profits rate of 20%.

On 15 August 2012 Rod Ltd sold an office building, and this resulted in a chargeable gain of £120,000. On 20 February 2013 Stick Ltd sold a factory and this resulted in a capital loss of £35,000.

As at 1 April 2012 Stick Ltd had unused capital losses of £40,000.

· Rod Ltd and Stick Ltd must make a joint election by 31 March 2015, being two years after the end of the accounting period in which the disposal outside of the group occurred.

· Stick Ltd’s otherwise unused capital loss of £35,000 and brought forward capital losses of £40,000 can be set against the chargeable gain of £120,000.

· It is beneficial for the balance of the gain of £45,000 (120,000 – 35,000 – 40,000) to arise in Stick Ltd as this company only pays corporation at the small profits rate of 20%.

Conclusion

With groups it is important that you know the group relationship that must exist for reliefs to be available. Where a question involves a group you can expect to spend more time than normal planning your answer. However, working through the examples in this article will prepare you for anything that could be set in the exam.

Written by a member of the Paper F6 examining team

精品好课免费试听