Syllabus:

Introduction of paper

AIM OF PAPER

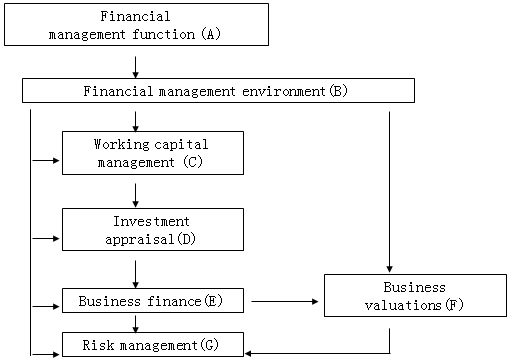

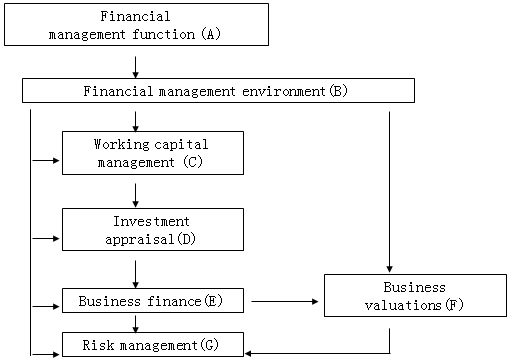

To develop the knowledge and skills expected of a finance manager, in relation to investment, financing, and dividend policy decisions.

Main Capabilities1.Discuss the

role and

purpose of the financial management function

2.Assess and discuss the

impact of the

economic environment on financial management

3.Discuss and apply

working capital management techniques

4.Carry out effective

investment appraisal 5.Identify and evaluate alternative

sources of

business finance6.Discuss and apply principles of

business and

asset valuations7.Explain and apply

risk management techniques in business.

DETAILED SYLLABUS

A.Financial management function

1.The nature and purpose of financial management

2.Financial objectives and relationship with corporate strategy

3.Stakeholders and impact on corporate objectives

4.Financial and other objectives in not-for-profit organisations

B.Financial management environment

1.The economic environment for business

2.The nature and role of financial markets and institutions

3.The nature and role of money market

C.Working capital management

1.The nature, elements and importance of working capital

2.Management of inventories, accounts receivable, accounts payable and cash

3.Determining working capital needs and funding strategies

D.Investment appraisal

1.Investment appraisal techniques

2.Allowing for inflation and taxation in investment appraisal

3.Adjusting for risk and uncertainty in investment appraisal

4.Specific investment decisions (lease or buy; asset replacement, capital rationing)

E.Business finance

1.Sources of, and raising business finance

2.Estimating the cost of capital

3.Sources of finance and their relative costs

4.Capital structure theories and practical considerations

5.Finance for small- and medium-sized entities (SMEs)

F.Business valuations

1.Nature and purpose of the valuation of business and financial assets

2.Models for the valuation of shares

3.The valuation of debt and other financial assets

4.Efficient market hypothesis (EMH) and practical considerations in the valuation of shares

G.Risk management

1.The nature and types of risk and approaches to risk management

2.Causes of exchange rate differences and interest rate fluctuations

3.Hedging techniques for foreign currency risk

4.Hedging techniques for interest rate risk

添加学习顾问

添加学习顾问