内容安排:

1.主观题练习 - 独体报表

- 合并报表

- 报表分析

2.客观题练习

以上全部以历年真题为主!

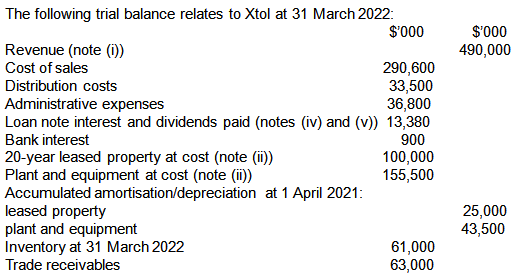

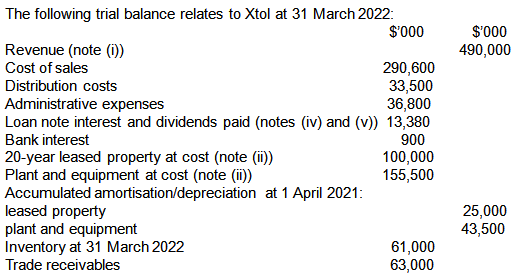

The following trial balance relates to Xtol at 31 March 2022:

The following notes are relevant:

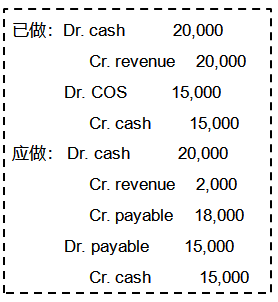

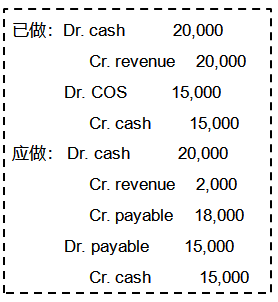

(i) Revenue includes an amount of $20 million for cash sales made through Xtol’s retail outlets during the year on behalf of Francais. Xtol, acting as agent, is entitled to a commission of 10% of the selling price of these goods. By 31 March 2022, Xtol had remitted to Francais $15 million (of the $20 million sales) and recorded this amount in cost of sales.

w1 revenue

Dr. revenue 18,000

Cr. T.P. 3,000

Cr. COS 15,000

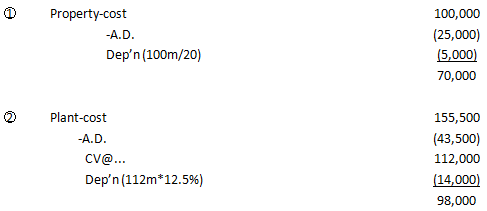

(ii) Plant and equipment is depreciated at 12½% per annum on the reducing balance basis. All amortisation/depreciation of non-current assets is charged to cost of sales.

(ii)On 1 August 2021, Xtol made a fully subscribed rights issue of equity share capital based on two new shares at 60 cents each for every five shares held. The market price of Xtol’s shares before the issue was $1.02 each. The issue has been fully recorded in the trial balance figures.

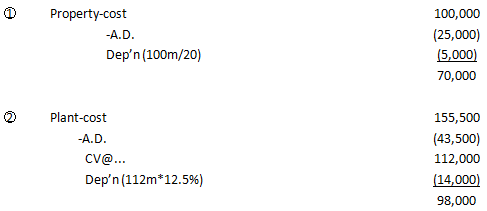

w2 PPE

w3 issue of shares

No. of shares at year end 56m/0.25=224m

No. of shares before right issue 224m*5/7=160m

Equity share at 1.4.2021 160m*0.25=40m

Increase in share premium (224-160)*(0.6-0.25)=22.4m

Share premium at 1.4.2021 25m-22.4m=2.6m

(iii)On 1 April 2021, Xtol issued a 5% $50 million convertible loan note at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par or convertible into equity shares at the option of the loan note holders on 31 March 2024. The interest on an equivalent loan note without the conversion rights would be 8% per annum.

The present values of $1 receivable at the end of each year, based on discount rates of 5% and 8%, are:

5% 8%

End of year 1 0.95 0.93

2 0.91 0.86

3 0.86 0.79

w4 convertible loan

| Yr |

CF |

DF |

PV |

| 1 |

2500 |

0.93 |

2325 |

| 2 |

2500 |

0.86 |

2150 |

| 3 |

52500 |

0.79 |

41475 |

| |

|

Liability |

45950 |

| |

|

Equity |

4050 |

| |

|

|

50000 |

| Financial liability @ 1.4.2021 |

45950 |

| Financial cost (45950*8%) |

3676 |

| Interest paid |

(2500) |

| |

47126 |

(iv)An equity dividend of 4 cents per share was paid on 30 May 2021 and, after the rights issue, a further dividend of 2 cents per share was paid on 30 November 2021.

(vi) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2021. A provision of $28 million is required for current tax for the year ended 31 March 2022 and at this date the deferred tax liability was assessed at $8.3 million.

w5 dividend paid

(1) 13380-2500=10880

(2) 160m*0.04+224m*0.02=10880

w6 taxation

IT-CT:3200 + 28000= $31,000

IT-DT: opening DTL 4,600

it-DT (β)

3,700

ending DTL 8,300

Total income tax for the year would be $34,900 (3700 + 31200)

Required:

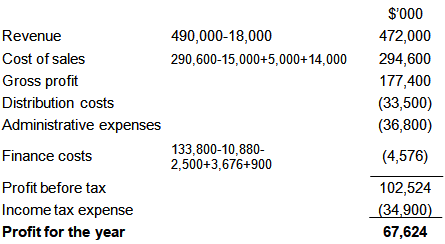

(a) Prepare the statement of profit or loss for Xtol for the year ended 31 March 2022.

(b) Prepare the statement of changes in equity for Xtol for the year ended 31 March 2022.

(c) Prepare the statement of financial position for Xtol as at 31 March 2022.

Note: Answers and workings (for parts (a) to (c) ) should be presented to the nearest $1,000; notes to the financial statements are not required.

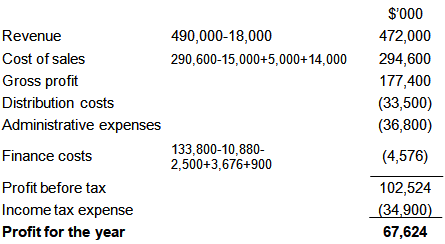

Statement of profit or loss for Xtol for the year ended 31 March 2022.

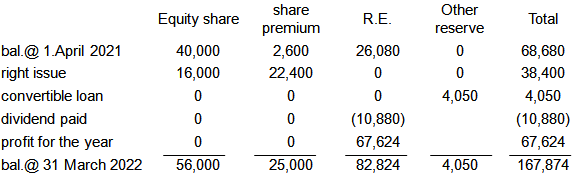

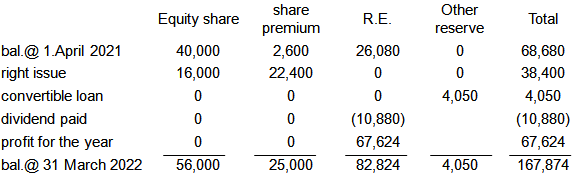

Statement of changes in equity for Xtol for the year ended 31 March 2022.

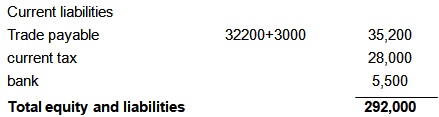

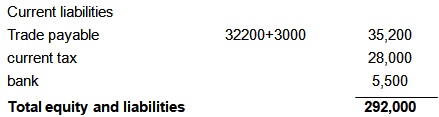

Statement of financial position for Xtol as at 31 March 2022.

添加学习顾问

添加学习顾问