"investment portfolio" exercise : standard deviation

学习是一个不断积累的过程,每天学习一点,每天进步一点!为了帮助大家更高效地备考2021年CFA考试,正保会计网校每日为大家上新CFA习题供大家练习。让网校与您一起高效备考2021年CFA考试,梦想成真!

Questions 1:

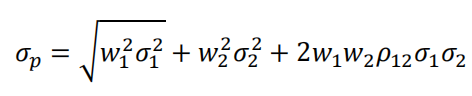

Based on the following historical data, which is closest to the standard deviation for the two-asset portfolio shown in the table?

| Asset A | Asset B | Asset C | |

| Standard deviation | 4.7% | 7.7% | |

| Portfolio weight | 0.4 | 0.6 | |

| Correlation | 0.3 |

By accessing this mock exam, you agree to the following terms of use: This mock exam is provided to currently- registered CFA candidates. Candidates may view and print the exam for personal exam preparation only. The following activities are strictly prohibited and may result in disciplinary and/or legal action: accessing or permitting access by anyone other than currently-registered CFA candidates; copying, posting to any website, emailing, distributing and/or reprinting the mock exam for any purpose.

A. 6.5%

B. 5.5%

C. 5.0%

Questions 2:

When considering a portfolio that is optimal for one investor, a second investor with a higher risk aversion would most likely:

A. expect a higher variance for the portfolio.

B. derive a lower utility from the portfolio.

C. have a lower return expectation for the portfolio.

Utility has two terms: the expected return and a negative term based on the portfolio risk weighted by risk aversion. For an identical portfolio, the investor with a higher risk aversion (A) would calculate a lower utility (U).

U=E(r)-½Aσ

成功=时间+方法,自制力是这个等式的保障。世上无天才,高手都是来自刻苦的练习。而人们经常只看到“牛人”闪耀的成绩,其成绩背后无比寂寞的勤奋。小编相信,每天都在勤奋练习,即使是一点点的进步,大家一定可以成为人人称赞的“牛人”。