"Financial Report":Treasury stock method

学习是一个不断积累的过程,每天学习一点,每天进步一点!为了帮助大家更高效地备考2021年CFA考试,正保会计网校每日为大家上新CFA习题供大家练习。让网校与您一起高效备考2021年CFA考试,梦想成真!

Questions 1:

A retailer provides credit cards only to its most valued customers who pass a rigorous credit check. A credit card customer ordered an item from the retailer in May. The item was shipped and delivered in July. The item appeared on the customer’s July credit card statement and was paid in full by the due date in August. The most appropriate month in which the retailer should recognize the revenue is:

A 、May.

B、 July.

C、 August.

Questions 2:

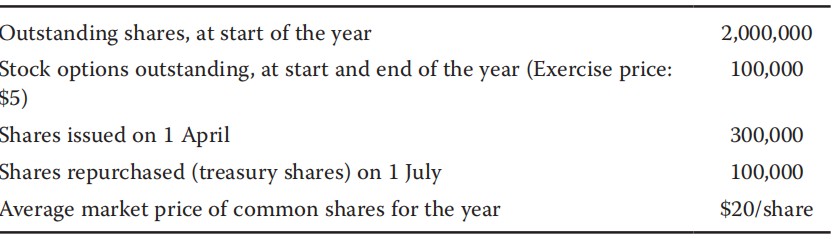

The following relates to a company’s common equity over the course of the year:

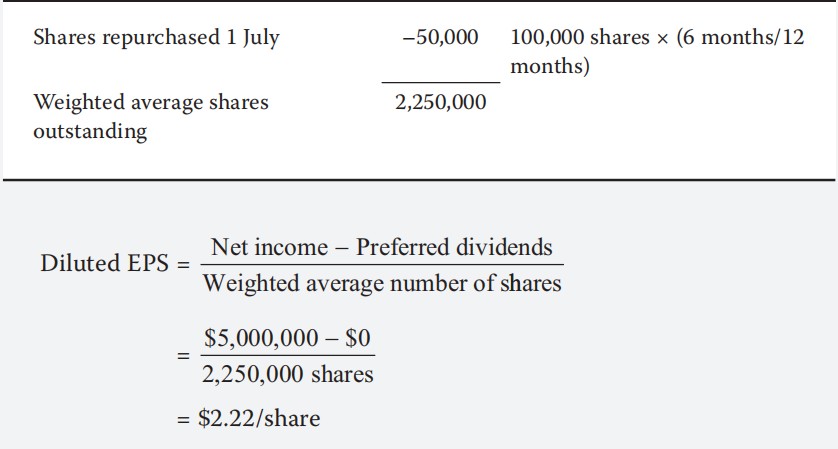

If the company’s net income for the year is $5,000,000, its diluted EPS is closest to:

A、 $2.17.

B、 $2.22.

C、 $2.20.

B is correct. The appropriate time to recognize revenue would be in the month of July because the risks and rewards have been transferred to the buyer (shipped and delivered), the revenue can be reliably measured, and it is probable that the economic benefits will flow to the seller (the rigorous credit check was completed). Neither the actual payment date nor the credit card statement date is relevant here.

A is incorrect. The order date is not relevant here because all of the critical elements in the revenue recognition process are not satisfied until July.

C is incorrect. The payment date is not relevant here because all of the critical elements in the revenue recognition process are not satisfied until July.

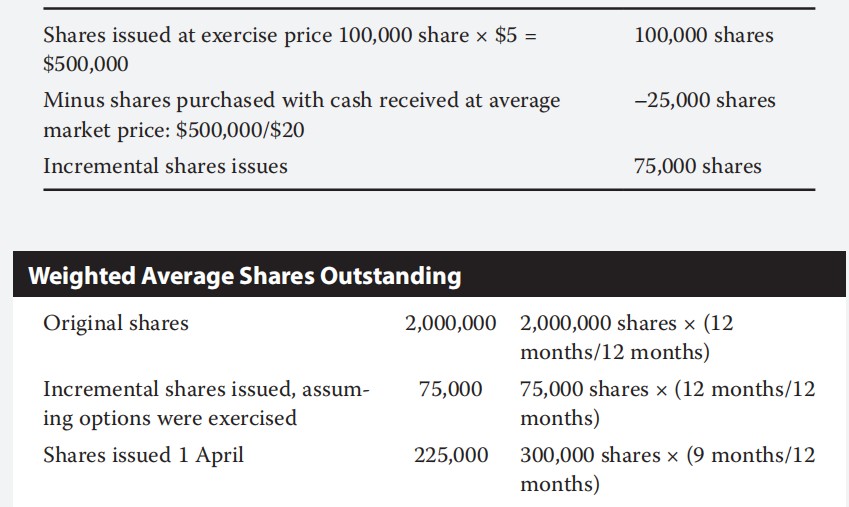

B is correct. First, determine the incremental shares issued from stock option exercise (treasury stock method):

A is incorrect. It includes the options at full value not using the Treasury stock method and forgets to prorate the others issued and repurchased $5,000,000/(2,000,000 +100,000 + 300,000 – 100,000) = 2.17

C is incorrect. It does not prorate the new shares issued or repurchased for the length of time outstanding: (2,000 + 75 + 300 – 100) = 2,275; 5,000/2,275 = 2.20. Or it ignores the buyback: (2,000 + 100 + 225 – 50) = 2,275; 5,000/2,275 = 2.198 = 2.20.

成功=时间+方法,自制力是这个等式的保障。世上无天才,高手都是来自刻苦的练习。而人们经常只看到“牛人”闪耀的成绩,其成绩背后无比寂寞的勤奋。小编相信,每天都在勤奋练习,即使是一点点的进步,大家一定可以成为人人称赞的“牛人”。