"Portfolio Management": annualized return

学习是一个不断积累的过程,每天学习一点,每天进步一点!为了帮助大家更高效地备考2021年CFA考试,正保会计网校每日为大家上新CFA习题供大家练习。让网校与您一起高效备考2021年CFA考试,梦想成真!

Questions 1:

The return measure that best allows one to compare asset returns earned over different length time periods is the:

A、 holding period return.

B 、annualized return.

C 、net portfolio return.

Questions 2:

When considering a portfolio that is optimal for one investor, a second investor with a higher risk aversion would most likely:

A、 expect a higher variance for the portfolio.

B、 derive a lower utility from the portfolio.

C、 have a lower return expectation for the portfolio.

B is correct. The annualized return is an average return measure that can be calculated using return data for a period that is shorter (or longer) than one year. In many cases, it is most convenient to annualize all available returns in order to compare returns when the time periods during which a return is earned or computed vary. It reflects the return that would be earned over a one-year period, assuming that money can be reinvested repeatedly while earning a similar return.

A is incorrect. The holding period return is defined as the return earned from holding an asset for a single specified period of time.

C is incorrect. The portfolio return is simply a weighted average of the returns of the individual investments or assets in a portfolio. Returns to different portfolios may be calculated over different time periods and may not be comparable.

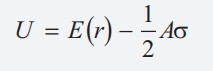

B is correct. Utility has two terms: the expected return and a negative term based on the portfolio risk weighted by risk aversion. For an identical portfolio, the investor with a higher risk aversion (A) would calculate a lower utility (U).

A is incorrect. The expected variance of the portfolio is fixed. It does not change based on the preferences of different investors. C is incorrect. The expected return of the portfolio is fixed. It does not change based on the preferences of different investors.

成功=时间+方法,自制力是这个等式的保障。世上无天才,高手都是来自刻苦的练习。而人们经常只看到“牛人”闪耀的成绩,其成绩背后无比寂寞的勤奋。小编相信,每天都在勤奋练习,即使是一点点的进步,大家一定可以成为人人称赞的“牛人”。