"Corporate Finance":weighted average cost of capital

学习是一个不断积累的过程,每天学习一点,每天进步一点!为了帮助大家更高效地备考2021年CFA考试,正保会计网校每日为大家上新CFA习题供大家练习。让网校与您一起高效备考2021年CFA考试,梦想成真!

Questions 1:

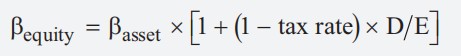

A company’s asset beta is 1.2 based on a debt-to-equity ratio (D/E) of 50%. If the company’s tax rate increases, the associated equity beta will most likely:

A、 increase.

B、 decrease.

C 、remain unchanged.

Questions 2:

The following information is available for a company:

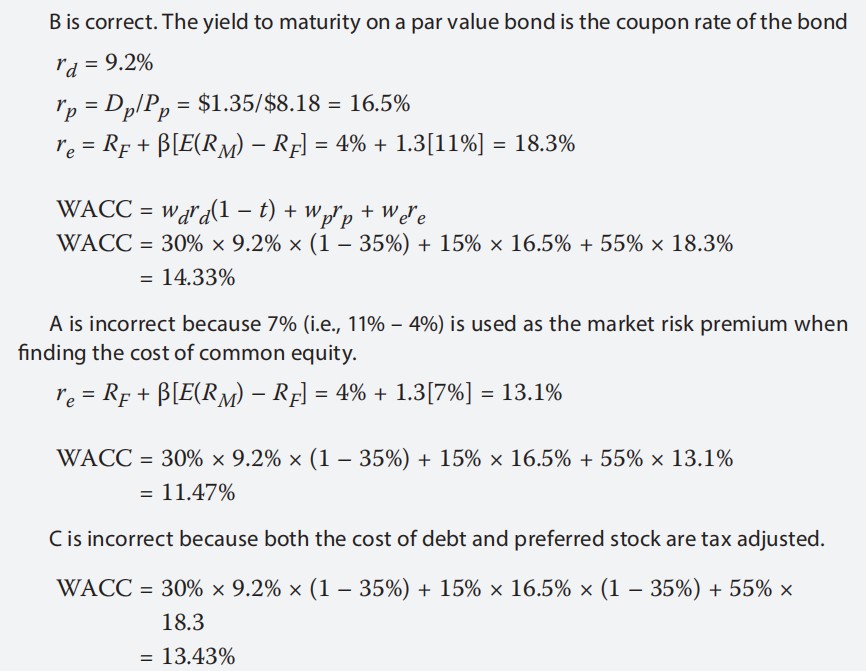

● Bonds are priced at par and have an annual coupon rate of 9.2%.

● Preferred stock is priced at $8.18 and pays an annual dividend of $1.35.

● Common equity has a beta of 1.3.

● The risk-free rate is 4% and the market premium is 11%.

● Capital structure: Debt = 30%; Preferred stock = 15%; Common equity =

55%.

● The tax rate is 35%.

The weighted average cost of capital (WACC) for the company is closest to:

A 、11.5%.

B、 14.3%.

C 、13.4%.

B is correct.

If the tax rate increases, then the bracketed term (1 – tax rate) decreases, making the equity beta decrease because the asset beta is unchanged.

A is incorrect because the equity beta decreases.

C is incorrect because the equity beta decreases.

【analysis】

成功=时间+方法,自制力是这个等式的保障。世上无天才,高手都是来自刻苦的练习。而人们经常只看到“牛人”闪耀的成绩,其成绩背后无比寂寞的勤奋。小编相信,每天都在勤奋练习,即使是一点点的进步,大家一定可以成为人人称赞的“牛人”。