"Financial Report":deferred tax assets

学习是一个不断积累的过程,每天学习一点,每天进步一点!为了帮助大家更高效地备考2021年CFA考试,正保会计网校每日为大家上新CFA习题供大家练习。让网校与您一起高效备考2021年CFA考试,梦想成真!

Questions 1:

If a company has a deferred tax asset reported on its statement of financial position and the tax authorities reduce the tax rate, which of the following statements is most accurate concerning the effect of the change? The existing deferred tax asset will:

A、 not be affected.

B、 increase in value.

C、 decrease in value.

Questions 2:

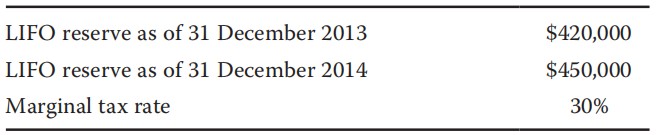

An analyst gathers the following information about a company:

If the company had used the first-in, first-out (FIFO) method instead of last-in, first-out (LIFO), its 2014 net income would most likely have been:

A、 $9,000 higher.

B 、$21,000 higher.

C、 $30,000 lower.

C is correct. A decrease in the tax rate will result in a decrease in the previously reported amounts of deferred tax assets. That is, the value of the future tax assets, based on the new lower rate, is reduced for offsetting future tax payments.

A is incorrect. The change would affect not only the current year’s reported income tax expense but also any amounts previously established on the balance sheet.

B is incorrect. The value of the future benefits decreases, not increases.

B is correct

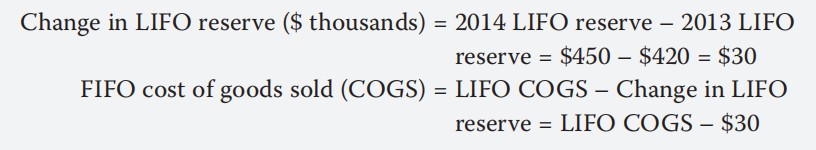

If an increase in the LIFO reserve occurs, LIFO COGS will be higher than FIFO by the amount of the increase. With a lower COGS under FIFO, pretax income will be higher by $30,000. With a lower COGS under FIFO, after-tax income will be higher by $30,000 × (1 – 0.30) = $21,000.

A is incorrect. Tax rate × change in LIFO reserve = 0.30 × ($450,000 – $420,000) = $9,000

C is incorrect. Change in the LIFO reserve = $450,000 – $420,000 = $30,000

成功=时间+方法,自制力是这个等式的保障。世上无天才,高手都是来自刻苦的练习。而人们经常只看到“牛人”闪耀的成绩,其成绩背后无比寂寞的勤奋。小编相信,每天都在勤奋练习,即使是一点点的进步,大家一定可以成为人人称赞的“牛人”。