"Equity Investments": Financial Analysis Techniques

学习是一个不断积累的过程,每天学习一点,每天进步一点!为了帮助大家更高效地备考2021年CFA考试,正保会计网校每日为大家上新CFA习题供大家练习。让网校与您一起高效备考2021年CFA考试,梦想成真!

Questions 1:

A firm reports negative earnings for the year just ended. The price multiple of the firm’s stock that is least likely to be meaningful is:

A 、trailing price to earnings.

B、 price to cash flow.

C、 leading price to earnings.

Questions 2:

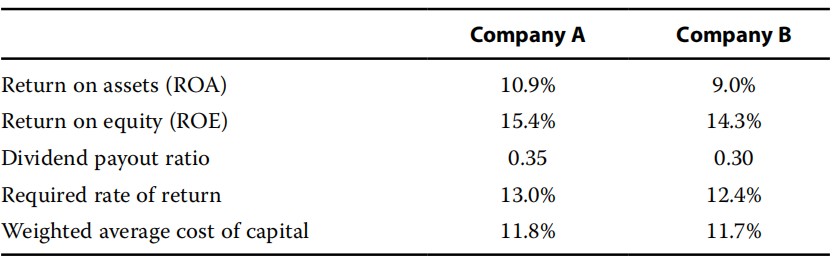

A fund manager compiles the following data on two companies:

The best conclusion the fund manager can make is that Company A’s stock is more attractive than Company B’s stock because of its:

A 、smaller price-to-earnings ratio (P/E).

B、 greater financial leverage.

C、 higher dividend growth rate.

A is correct. Negative earnings in the last year result in a negative ratio of trailing price to earnings and are not meaningful. Practitioners may use the ratio of (1) current price to cash flow or (2) leading price to earnings by replacing last year’s loss with forecasted earnings.

B is incorrect. Alternative to negative trailing price-to-earnings ratio, practitioners may use price-to-cash-flow ratio because it is possible cash flow would be positive in spite of a small loss.

C is incorrect. Alternative to negative trailing price-to-earnings ratio, practitioners may use leading price-to-earnings ratio by replacing last year’s loss with forecasted earnings which may be positive.

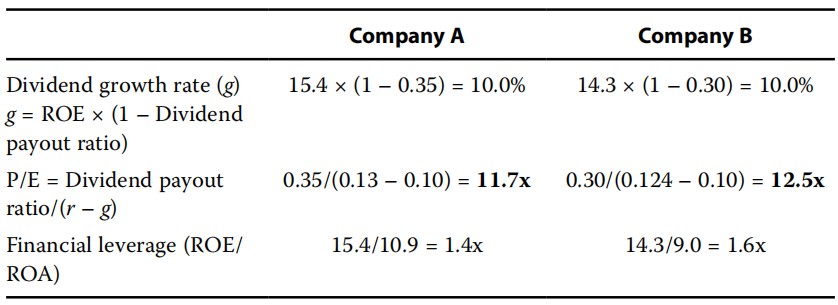

A is correct. From the following computations, Company A’s stock is more attractive than Company B’s stock because of its smaller P/E.

B is incorrect. Company A’s financial leverage is lower than that of Company B.

C is incorrect. The dividend growth rate is the same for both firms.

成功=时间+方法,自制力是这个等式的保障。世上无天才,高手都是来自刻苦的练习。而人们经常只看到“牛人”闪耀的成绩,其成绩背后无比寂寞的勤奋。小编相信,每天都在勤奋练习,即使是一点点的进步,大家一定可以成为人人称赞的“牛人”。更多CFA考试资讯,点击了解>