"Portfolio Management":Portfolio Risk and Return: Part I

学习是一个不断积累的过程,每天学习一点,每天进步一点!为了帮助大家更高效地备考2021年CFA考试,正保会计网校每日为大家上新CFA习题供大家练习。让网校与您一起高效备考2021年CFA考试,梦想成真!

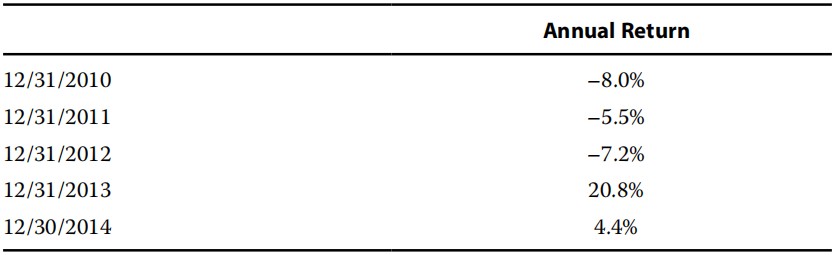

Questions 1:

Based on the information in the table, which of the following is closest to the geometric mean annual return for the full period of 2010–2014?

A 、0.90%

B、 1.75%

C、 0.35%

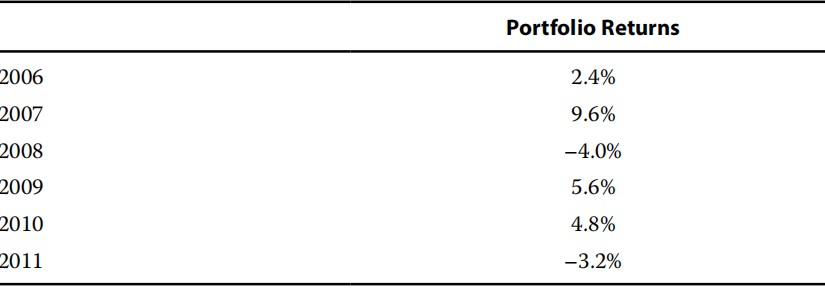

Questions 2:

A portfolio has the following returns:

The sample variance of the portfolio is closest to:

A 、0.23%.

B、 0.36%.

C、 0.28%.

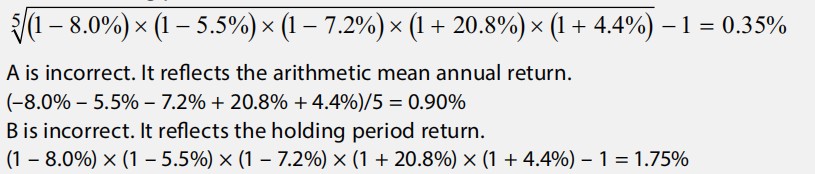

C is correct. The geometric mean annual return is computed multiplicatively as the nth root of the holding period.

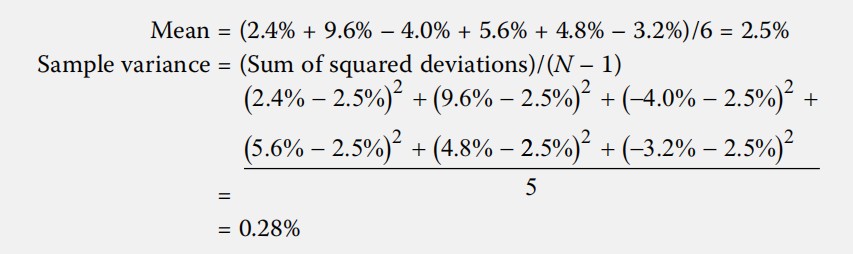

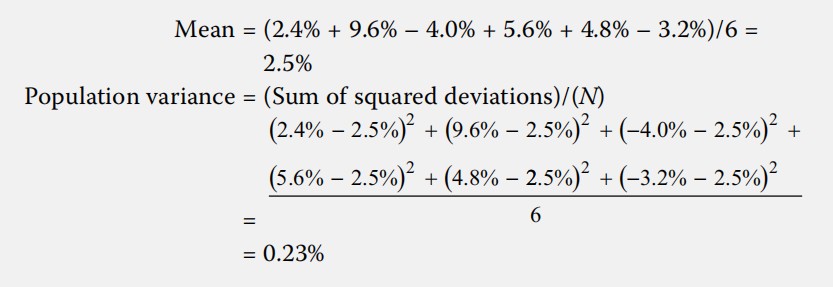

C is correct. The sample variance is calculated as the sum of squared deviations from the arithmetic mean.

A is incorrect. This is the calculation for population variance, which differs from the calculation for sample variance by the use of N in the denominator.

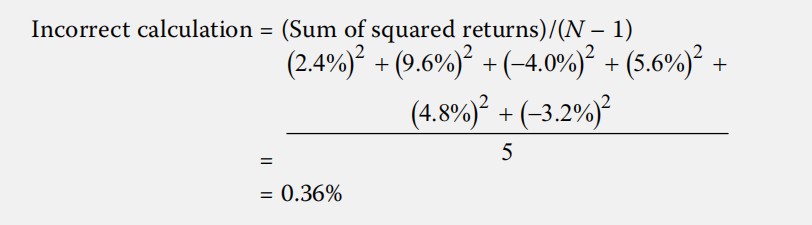

B is incorrect. The correct calculation requires subtraction of the mean before the values are squared and summed. This calculation is the sum of squares of the returns, not of the deviations.

成功=时间+方法,自制力是这个等式的保障。世上无天才,高手都是来自刻苦的练习。而人们经常只看到“牛人”闪耀的成绩,其成绩背后无比寂寞的勤奋。小编相信,每天都在勤奋练习,即使是一点点的进步,大家一定可以成为人人称赞的“牛人”。更多CFA考试资讯,点击了解>