"Corporate Finance":Internal rate of return

学习是一个不断积累的过程,每天学习一点,每天进步一点!为了帮助大家更高效地备考2021年CFA考试,正保会计网校每日为大家上新CFA习题供大家练习。让网校与您一起高效备考2021年CFA考试,梦想成真!

Questions 1:

A firm is considering a project that would require an initial investment of THB270 million (Thai baht). The project will help increase the firm’s after-tax net cash flows by THB30 million per year in perpetuity, and it is found to have a negative NPV of THB20 million. The IRR (%) of the project is closest to:

A、 11.1%.

B、 10.3%.

C、 12.0%

Questions 2:

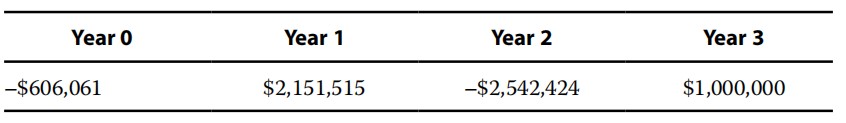

A project has the following annual cash flows:

Which discount rate most likely provides a positive net present value (NPV)?

A.、 15%

B 、21%

C、 18%

A is correct. The IRR is the discount rate that makes the NPV = 0. Because the cash flow stream is in perpetuity, it can be solved as follows: 0 = –270 + (30/IRR) IRR = 11.1%

B is incorrect. It assumes a positive NPV of 20 and solves for IRR = 30/290 = 10.34%.

C is incorrect. It assumes a negative NPV of 20 and solves for IRR = 30/250 = 12.00%.

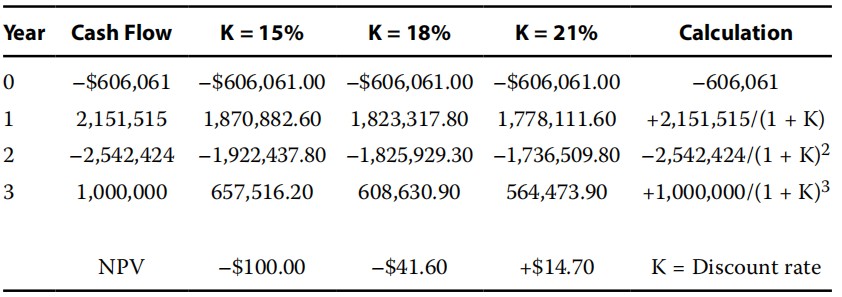

B is correct.

The NPV at 21% is $14.7, whereas the other two NPVs are negative.

A is incorrect because it has a negative NPV.

C is incorrect because it has a negative NPV.

成功=时间+方法,自制力是这个等式的保障。世上无天才,高手都是来自刻苦的练习。而人们经常只看到“牛人”闪耀的成绩,其成绩背后无比寂寞的勤奋。小编相信,每天都在勤奋练习,即使是一点点的进步,大家一定可以成为人人称赞的“牛人”。更多CFA考试资讯,点击了解>