"Fixed Income":Calculate the equivalent yield of bonds

学习是一个不断积累的过程,每天学习一点,每天进步一点!为了帮助大家更高效地备考2021年CFA考试,正保会计网校每日为大家上新CFA习题供大家练习。让网校与您一起高效备考2021年CFA考试,梦想成真!

Questions 1:

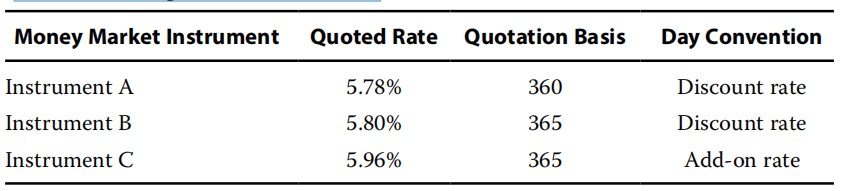

Which of the following 90-day money market instruments most likely offers the investor the highest rate of return?

A 、Instrument A

B、 Instrument C

C 、Instrument B

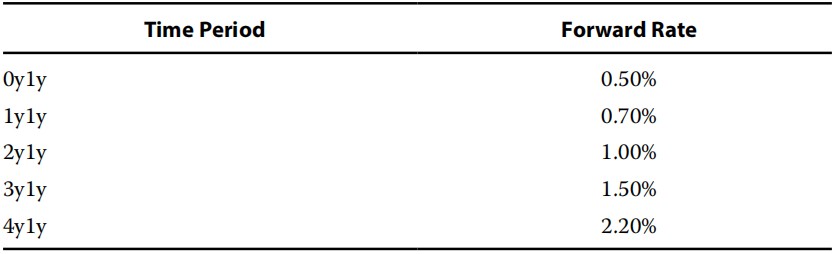

Questions 2:

Assume the following annual forward rates were calculated from the yield curve.

The four-year spot rate is closest to:

A 、0.924%.

B 、1.348%.

C 、1.178%.

B is correct. Instrument C provides a bond equivalent yield of 5.96%, compared with 5.946% for Instrument A and 5.883% for Instrument B.

A is incorrect. To calculate the bond equivalent yield:

FV = 100, Days = 90, Year = 360, DR = 0.0578.

PV = 100 × [1 – (90/360) × 0.0578] = 98.555 AOR = (365/90) × [(100 – 98.555)/98.555] = 5.946%

C is incorrect. To calculate the bond equivalent yield:

FV = 100, Days = 90, Year = 365, DR = 0.058.

PV = 100 × [1 – (90/365) × 0.058] = 98.570 AOR = (365/90) × [(100 – 98.570)/98.5705] = 5.883%

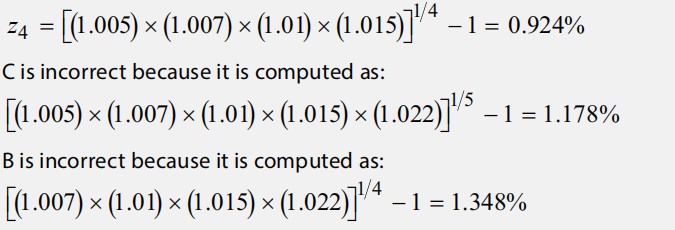

A is correct. The four-year spot rate can be computed as:

成功=时间+方法,自制力是这个等式的保障。世上无天才,高手都是来自刻苦的练习。而人们经常只看到“牛人”闪耀的成绩,其成绩背后无比寂寞的勤奋。小编相信,每天都在勤奋练习,即使是一点点的进步,大家一定可以成为人人称赞的“牛人”。更多CFA考试资讯,点击了解>