"Fixed Income":Fundamentals of Credit Analysis

学习是一个不断积累的过程,每天学习一点,每天进步一点!为了帮助大家更高效地备考2021年CFA考试,正保会计网校每日为大家上新CFA习题供大家练习。让网校与您一起高效备考2021年CFA考试,梦想成真!

Questions 1:

For two equally rated speculative grade bonds, what factor is least likely to account for differences in their valuation?

A 、Severity of loss

B 、Probability of default

C 、Perceived creditworthiness of the companies

Questions 2:

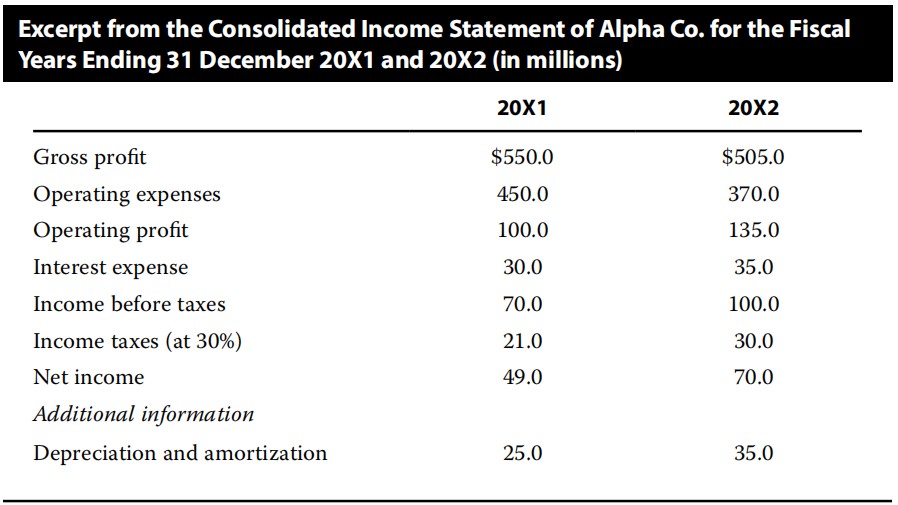

A credit analyst observes the following information for Alpha Co. at fiscal years ending 20X1 and 20X2.

Based on this information, over this period Alpha’s interest coverage ratio has:

A 、improved.

B、 remained unchanged.

C、 deteriorated.

B is correct. In the case of speculative grade bonds, two bonds with the same credit ratings will tend to have the same probabilities of default. They may still trade at very different valuations because for such bonds the market typically begins focusing on the severity of loss in the event of default, which can be quite different for similarly rated bonds.

A is incorrect because for speculative grade bonds with similar credit ratings the valuations may be quite different if the severity of loss associated with the two bonds is very different from each other.

C is incorrect because if there is a perceived difference in credit quality there is a difference in valuation.

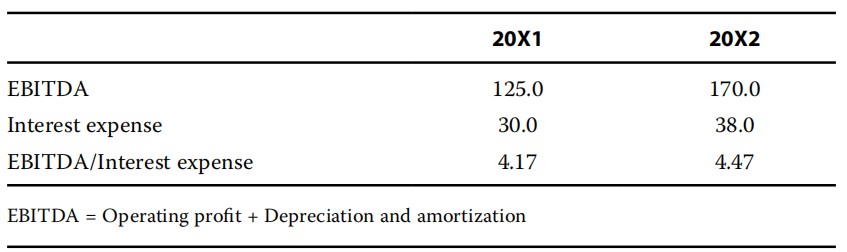

A is correct. The company’s interest coverage ratio can be computed as EBITDA/Interest expense. That is:

The company’s EBITDA interest coverage ratio has improved over this period. If EBIT is used to calculate the coverage ratios, the same conclusion is reached: for 20X1 the ratio is 3.33, and for 20X2 it is 3.86.

B is incorrect because the EBITDA interest coverage ratio has improved over this period.

C is incorrect because the EBITDA interest coverage ratio has improved over this period.

成功=时间+方法,自制力是这个等式的保障。世上无天才,高手都是来自刻苦的练习。而人们经常只看到“牛人”闪耀的成绩,其成绩背后无比寂寞的勤奋。小编相信,每天都在勤奋练习,即使是一点点的进步,大家一定可以成为人人称赞的“牛人”。更多CFA考试资讯,点击了解>