AICPA协会公布了USCPA考试2019年考试大纲更新内容!本考纲的生效时间是2019年USCPA考试第一考季(2019年1月1日起实行)。

网校USCPA教学团队针对此次大纲修改,整理了如下内容:

这次考纲更新受影响的科目有AUD、FAR和REG。其中,REG由于受到P.L. 115-97, the Tax Cuts and Jobs Act,也就是俗称的特朗普税改的影响,在联邦个人所得税与公司所得税部分有较大的改动。

FAR / AUD这两门的变动较少。BEC由于此前考试大纲已经针对COSO ERM进行了部分改动,此次2019年1月1日生效的大纲则没有再对BEC进行任何调整。

下面,我们就来按照科目分类,分别为大家介绍2019年USCPA考试大纲变动的内容。

FAR

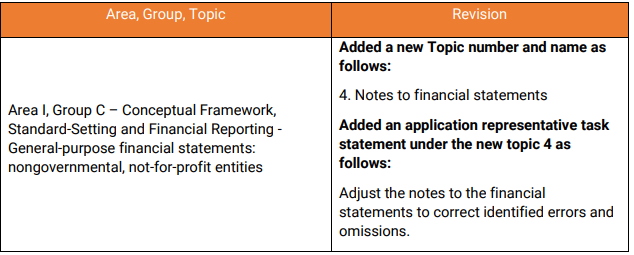

由于受到非政府性以及非盈利组织财报的相关规定的颁布,FAR科目的变化体现在:

· 增加了新的topic:Notes to financial statements (of nongovernmental, not-for-profit entities)

· 调整非政府性以及非盈利组织财务报表的注释,纠正错误和遗漏。

AUD

对于Professional Skepticism,即审计师的职业怀疑的相关要求添加了更多的细节。但是,相关补充不影响AUD的考试范围与内容设置。这一补充主要是使得考生更明确自己在AUD课程学习中对Professional Skepticism需要掌握与理解的程度,以及AUD考试对这些知识点的测试深度。

大纲中针对不同的知识点考察范围,加入了以下分析性及代表性任务:

Ethics, Professional Responsibilities and General Principles – Ethics, independence and professional conduct

· Understand the concepts of professional skepticism and professional judgment.

· Understand personal bias and other impediments to acting with professional skepticism, such as threats, incentives and judgment-making shortcuts.

Performing Further Procedures and Obtaining Evidence - Understanding sufficient appropriate evidence

· Investigate evidence that either contradicts or corroborates management explanations, expectations and other hypotheses throughout an audit or non-audit engagement.

Performing Further Procedures and Obtaining Evidence - Performing specific procedures to obtain evidence - Inquiry of management and others

· Analyze responses obtained during structured or informal interviews with management and others, including those in non-financial roles, and ask relevant and effective follow-up questions to understand their perspectives and motivations in an audit or non-audit engagement.

Performing Further Procedures and Obtaining Evidence - Performing specific procedures to obtain evidence - All other procedures

· Modify planned procedures based upon new information, such as inconsistent explanations, new evidence and environmental cues, to achieve audit objectives in an audit of an issuer or a nonissuer.

REG

由于受“税收减免和工作法案”(TCJA)的发布与实施,预计在2019年Q1之后参加AICPA-REG考试的考生大多忧心忡忡,不知该如何是好。根据网校老师对于此次考纲的解读,改动涉及3个Area(REG考纲共5个Area),共12处变更。

变动的主要内容是“税收减免和工作法案”(TCJA)删除了Personal Exemption,AMT(Alternative Minimum Tax),以及针对跨司法区域税务处理 (multi-jurisdictional tax issues)的相关税法细则的修改。

改动内容分为三大类:修订(Revised),添加(Added),以及删除(Removed)。下面我们就来分别列示改动的相关内容:

修订(Revised)

· Compare the tax benefits of the different expensing options for tax depreciation for federal income tax purposes.

· Group name - Filing status

· Topic name - Computations of taxable income, taxliability and allowable credits

· Analyze the impact of net operating and/orcapital losses during tax planning for a Ccorporation.

· Calculate the revised basis of partnershipassets due to a transfer of a partnershipinterest for federal income tax purposes.

添加(Added)

· Calculate the qualifying business income(QBI) deduction for federal income taxpurposes.

· Recall relationships meeting the definitionof dependent for purposes of determiningtaxpayer filing status.

· Identify situations where the base erosionand anti-abuse tax (BEAT) would apply.

· Identify factors that would qualify incomeas Foreign Derived Intangible Income(FDII).

· Define the components of GlobalIntangible Low-Taxed Income (GILTI).

删除(Removed)

· Recall relationships qualifying for personal exemptions reported on federal Form 1040 — U.S. Individual Income Tax Return

· Identify the number of personal exemptions reported on federal Form 1040 — U.S. Individual Income Tax Return given a specifc scenario.

· Calculate alternative minimum taxable income and alternative minimum tax for a C corporation.

对于FAR、AUD、REG三个科目考试,考期在2018年12月31日之前的同学来说,此次大纲变动并不会对你们造成任何影响。而对于2019年1月1日起参加USCPA考试的同学,请密切关注网校USCPA辅导与Becker的课程更新情况,通过对于大纲改革内容的学习来夯实基础,更好地应对2019年美国注册会计师考试。 、

了解更多关于2019年USCPA考试大纲更新内容请咨询U.S.CPA教学老师>>

有意向报考USCPA考试的考生可点击下方按钮进行免费预评估,了解报考条件。

了解详情30000元/4科