Becker Professional Education

Financial Course – Updates Included in V1.2

|

Lecture

|

Page, Item

|

Update

|

| The following revisions to the V1.1 Financial textbook are included in the V1.2 Financial textbook to be released on October 27, 2015. Click here to view the updated pages. | ||

| F1 | Pages 27-28 | Extraordinary Items section deleted;U.S. GAAP has eliminated the concept of extraordinary items. Items of income or loss that are unusual or infrequent or both should be reported separately as part of income from continuing operations. U.S. GAAP and IFRS are now aligned in the treatment of unusual and/or infrequent items. |

| F1 | 18 II C 19 [Multi-step Income Statement.] 19, 21,29 [IDEA mnemonic] 25 G1 30 B2 (page 28 in V.1.2 textbook) 32 IV B (page 30 in V.1.2 textbook) 35 I B 3 (page 33 in V.1.2 textbook) 49 B 49 C1, C5 50 [Box, US GAAP vs. IFRS] 54 G 2 g 55 C9, G2 64 3rd item |

Various references to Extraordinary Items were deleted from these pages. Throughout the textbook, references to the IDEA mnemonic were changed to IDA. |

| F1 | Following page 46, new topic 5 (on pages 45 and 46 in the new V.1.2 textbook) | In 2014, the FASB issued ASU No. 2014-15—Presentation of Financial Statements—Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. A new topic, Going Concern, was added. |

| F1 | Appendix p. 64 in V1.1 FAR textbook |

A line-item for Going Concern was added to the Appendix: IFRS vs. U.S. GAAP. The addition is at the bottom of page F1-65 in the V1.2 FAR textbook. |

| F2 | Page 26 Note at bottom of page |

Corrected note should read: *Note: The brackets under the Years 1, 2, and 3 columns represent income, not losses. Thus, Year 1 net income per books is $5,000 and the subsequent $650 adjustment would decrease income by $650 to ($4,350). |

| F2 | Page 27 Item 5 |

Corrected item 5 should read: 5. The $400 paid in Year 3 represents prepaid rent. The ($400) adjustment to Year 3 removes the incorrect charge to income, and the 12/31/Year 3 balance sheet is adjusted to properly reflect the asset prepaid rent. |

|

Lecture

|

Page, Item

|

Update

|

| F2 | Page 38 II A 2 |

Revised item 2 heading should read: 2. Boot Is Paid = No Gain (< 25% rule) If the exchange lacks commercial substance and boot is paid, no gain is recognized. |

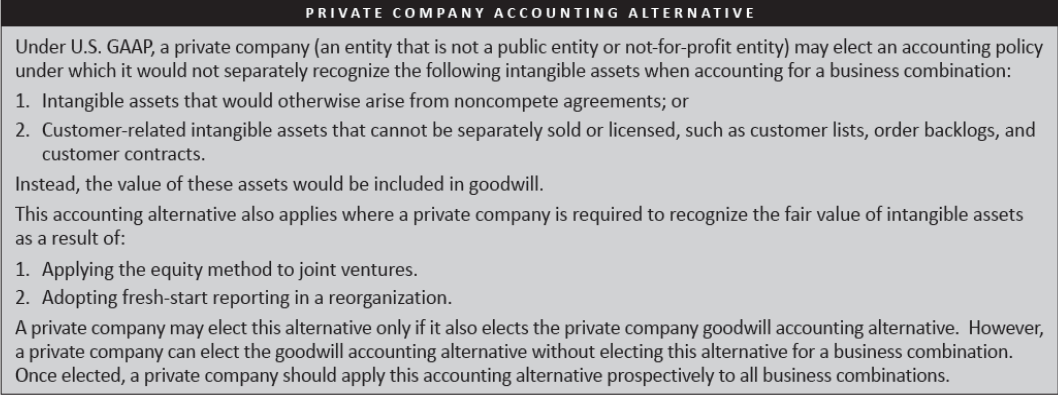

The following was added at the top of page F3-33: |

||

F4, pages 22-24 were updated for the following ASU, which is testable beginning April 1, 2015. This Pass Key is found on page 22 of F4. |

||

| F4 | Page 65 Appendix II IFRS vs. U.S. GAAP |

The first item is Inventory Valuation. Inthe U.S. GAAP column, the entry is updated for ASU 2015-11 as shown in the above Pass Key. |

| F5 | Page 37 and 38. Item G. Bond Issuance Costs |

The text for Bond Issuance Costs was rewritten to align with FASB ASU 2015-15 requiring that bond issuance costs be treated as a reduction of the bond carrying amount rather than as an intangible asset. Throughout the textbook, mentions of "bond issue cost" have been changed to "bond issuance cost" to conform to the language of ASU 2015-15. |

| F5 | Page 44 | Page 44 was replaced. It now shows an example of the amortization of bonds with bond issuance cost. |

|

Lecture

|

Page, Item

|

Update

|

| F5 | Page 55 through 58 XIII. Extinguishment of Debt |

Various revisions have been made to reflect the new guidance on bond issuance costs and to remove the concept of extraordinary items from U.S. GAAP. |

| F5 | Page 59, Appendix IFRS vs. U.S. GAAP |

Deleted line item for Bond Issue Costs. With ASU 2015-15, IFRS and U.S. GAAP treat bond issue costs in the same way. |

| F6 | Page 18 Item E, Measurement Date and Page 20, Item 1 c. |

Updated for new guidance on measurement date of the plan assets and benefit obligations of a defined benefit pension plan. |

| F6 | Page 33 II. Intraperiod Tax Allocation |

Extraordinary Items is removed from the IDEA mnemonic. |

| F7 | Pages 23, 28, 30 Earnings Per Share |

References to extraordinary items removed. |

| F8 | Appendix, page 82 | Appendix: Fair Value Measurement and Application (GASB 72) |

| F9 | Page 54, Pass Key | Delete the following from the end of the text in the Pass Key: "as revenue, but rather as liabilities." Sentence ends with "…are not recorded." |

| F10 | Pages 23 through 26 Troubled Debt Restructuring |

Section was revised to remove all references to Extraordinary Items. |

| F10 | Page 56 Appendix IFRS vs. U.S. GAAP |

Line item for Extraordinary Items removed. IFRS and U.S. GAAP rules are now the same. |

了解详情30000元/4科