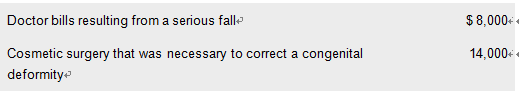

Carroll, a 35 year old unmarried taxpayer with an adjusted gross income of $100,000, incurred and paid the following unreimbursed medical expenses for the year:

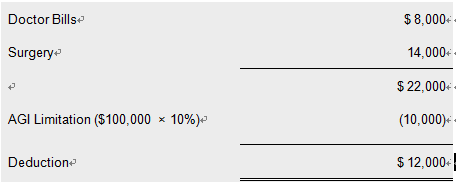

Carroll had no medical insurance. For regular income tax purposes, what was Carroll's maximum allowable medical expense deduction, after the applicable threshold limitation, for the year?

A. $14,000

B. $22,000

C. $0

D. $12,000

【答案解析】D

Choice "d" is correct. Both medical expenses are deductible. The cosmetic surgery is not elective, since it was necessary to correct a congenital deformity.

Choices "c", "a", and "b" are incorrect, per the computation above.

了解详情30000元/4科