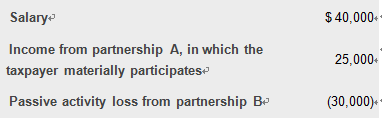

In the current year, a taxpayer reports the following items:

During the year, the taxpayer disposed of the interest in partnership B, which had a suspended loss carryover of $5,000 from prior years. What is the taxpayer's adjusted gross income for the current year?

A. $40,000

B. $45,000

C. $30,000

D. $20,000

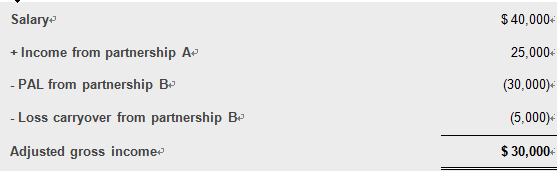

【答案解析】C

Choice "c" is correct. The $40,000 salary and income from partnership activity of $30,000 are taxable. Typically, passive activity losses, whether in the current or prior years, may only be used to offset passive activity income. The exception to this is in the year the passive activity is disposed of (sold), if still unused, passive activity losses are fully deductible in the year of disposal:

了解详情30000元/4科