ACCA F8 考试:MATTER OF OPINION (Part 1)

Relevant to ACCA Qualification Papers F8 and P7

It is one of the most fundamental concepts in auditing; auditors are paid to offer an opinion. It is what they do; it’s their ‘raison d’être.’ Why then, if the audit opinion is so significant, are audit examiners continually underwhelmed by candidates’ appreciation of this topic?

This article, which is relevant to Paper F8 and P7, revisits the basic principles of forming an audit opinion and looks at how this knowledge should be applied by considering a past Paper P7 exam question.

THE BASICS

When an auditor is able to satisfactorily conclude that the financial statements are free from material misstatement they express an unmodified opinion. The complete form and content of the unmodified opinion are presented in ISA 700, Forming an Opinion and Reporting on Financial Statements. However, auditors typically use one of two well-known phrases to reflect their conclusion, either:

• ‘The financial statements present fairly, in all material respects...’ or

• ‘The financial statements give a true and fair view of...’

MODIFICATIONS TO THE OPINION

There are two circumstances when the auditor may choose not to issue an unmodified opinion:

• When the financial statements are not free from material misstatement or

• When they have been unable to obtain sufficient appropriate evidence.

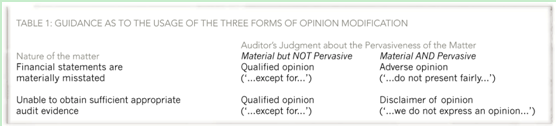

In these circumstances the auditor has to issue a modified version of their opinion. There are three types of modification. Their use depends upon the nature and severity of the matter under consideration.

They are:

• the qualified opinion

• the adverse opinion

• the disclaimer of opinion.

Guidance as to the usage of the three forms of modification is provided by ISA 705, Modifications to the Opinion in the Independent Auditor’s Report. This has been summarised in Table 1.

Pervasiveness is a matter that confuses many candidates as, once again, it is a matter that requires professional judgment. In this case the judgment is whether the matter is isolated to specific components of the financial statements, or whether the matter pervades many elements of the financial statements, rendering them unreliable as a whole.

The bottom line is that if the auditor believes that the financial statements may be relied upon in some part for decision making then the matter is material and not pervasive. If, however, they believe the financial statements should not be relied upon at all for making decisions then the matter is pervasive.

EMPHASIS OF MATTER

Emphasis of matter (EOM) is rarely dealt with satisfactorily in the exam. This is mainly because candidates believe that EOM is linked somehow to modifications of the opinion. This is not the case: EOM and modified opinions are totally separate matters.

The purpose of an EOM paragraph is to draw the users attention to a matter already disclosed in the financial statements because the auditor believes it is fundamental to their understanding. It is a way of saying to the users: ‘you know that note in the financial statements, the one about the uncertainty surrounding the legal dispute? Well us auditors think it’s really important, so make sure you’ve read it!’.

The usage of EOM paragraphs is described in ISA 706, Emphasis of Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor’s Report. This identifies three examples of circumstances when the usage of EOM is appropriate:

• when there is uncertainty about exceptional future events

• early adoption of new accounting standards and

• when a major catastrophe has had a major effect on the financial position.

Of course, in all of these examples the auditor can only refer back to disclosures already made in the financial statements. If the directors haven’t disclosed a matter as required by financial reporting standards, then the auditor may conclude that the financial statements are materially misstated and modify the opinion instead.

精品好课免费试听