考试考点内容:P3 Business analysis

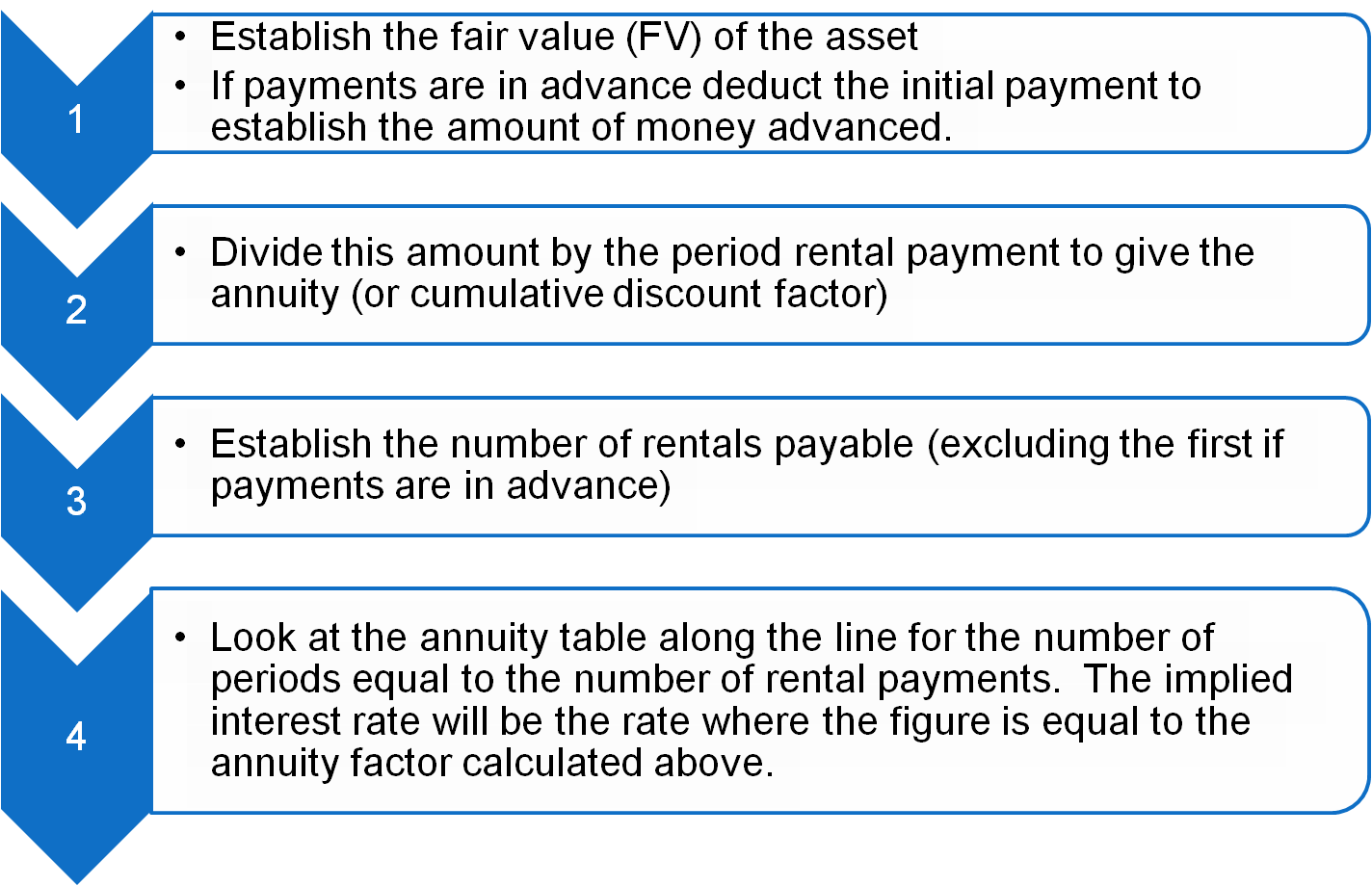

Interest rate implicit in a lease 利率是如何影响租赁计算价值:

The discount rate that when applied to the amounts the lessor expects to receive and retain, produces an amount equal to the fair value of the leased asset.

Note that this assumes that the secondary period rentals are nominal and ignores the residual value of equipment. Need to be aware of the complication of residual values and how this can be overcome but it will not be required to calculate an implied rate of interest where there is a residual value.

Determine the type of lease 根据计算决定租赁类型

Establish the future value of the asset

Calculate the present value of the future lease payments

Compare the future value of the asset with the present value of future lease payments

If present value equates to substantially all of the future value of the asset it will be categoriesd as a finance lease.

Apportion finance charge 租赁费用的分摊方式

The level spread (not permitted under IAS17)

The actuarial method (method recommended by IAS17)

The sum-of-digits method (acceptable approximation permitted by IAS17)

扫一扫,更多精彩内容等你来>>

精品好课免费试听