需要了解的名词及公式:

1. Capital structure

2. Gearing (D/D+E)

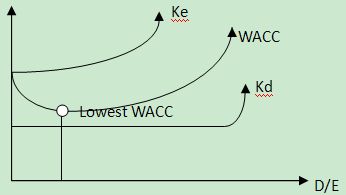

3. Cost of equity Ke

4. Cost of debt Kd

5. WACC= Keg*E/(D+E )+Kd*(1-tax rate)* D/(D+E) Keg: geared company

6. A company’s existing WACC should only be used as the discount rate for a potential project if the proportion of debt to equity does not change, project is financed by existing pool of funds, the project has the same business risk as existing operations.

7. Business risk: the volatility of operating profit due to the nature of the industry and country.

Financial risk: the additional variability in the return to equity (Ke) as a result of introducing debt, interest on debt is also a fixed cost which leads to even more volatile profits for shareholders.

8. Limitation of WACC:

Theoretically, it assumes perfect capital market; the market value of shares equals to the present value of dividend stream; market value of debt equals to the present value of interest/ principal; current WACC can only be used to assess projects which have similar business risk to that of existing operations; do not change the company’s gearing level, ie., financial risk

Practically, the estimation of g lacks of historical data; Gordon’s model only applies to all equity financed companies (g=r*b), and constant growth.

For calculation of Kd, it assumes constant tax rates, and complexities.

9.

Cost of capital

Companies seek the minimum level of WACC, assume the WACC as discount rate, the value of the company (CFs/ WACC) is maximized.

精品好课免费试听